Buyouts

Baird acquires e2v technologies spin-off for £15m

Baird Capital Partners Europe has acquired the instrumentation solutions business of listed UK firm e2v technologies for ТЃ15m.

Clessidra and Avista acquire Rottapharm

Clessidra Capital Partners and Avista Capital Partners have acquired a 50% stake in Italian drugmaker Rottapharm from the founding family in a deal that values the business at €1.7bn, according to reports.

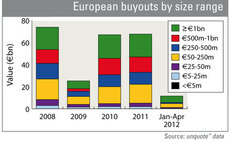

Buyout market could see worst year since 2009

Latest figures show Europe's buyout market has failed to recover from the market malaise of late 2011, brought on by the Eurozone crisis, particularly at the upper end of the market.

Buyout market could see worst year since 2009

Latest figures show Europe's buyout market has failed to recover from the market malaise of late 2011, brought on by the Eurozone crisis, particularly at the upper end of the market.

Primary Capital backs £35m MBO of Leisure Pass

Primary Capital has backed the ТЃ35m management buyout of London-based tourist pass systems provider Leisure Pass Group.

Bain Capital buys Bravida in tertiary buyout

Bain Capital has bought Swedish technical installation and services solutions company Bravida from Triton Partners in a tertiary buyout.

Endless acquires Bathstore

Turnaround investor Endless has bought UK-based bathroom retailer Bathstore from Wolseley for an estimated ТЃ15m.

Pinova buys Norafin Industries in MBO

Pinova Capital has acquired German speciality textile producer Norafin Industries from MAJ Invest’s holding company Vernal.

Buyout market could see worst year since 2009

Latest figures show Europe’s buyout market has failed to recover from the market malaise of late 2011, brought on by the Eurozone crisis, particularly at the upper end of the market.

Endless buys Cinesite

Turnaround investor Endless has acquired a 60% stake in London-based visual effects company Cinesite from Kodak.

Hands puts personal cash in Terra Firma fund

Guy Hands has pumped £20m of his own money into Terra Firma’s current fund, according to reports.

PE firms circle Premier Foods' spread businesses

TDR Capital, CapVest and Morgan Stanley Private Equity are reportedly due to submit first round bids for Sun Pat and Hartley's Jam, two businesses owned by Premier Foods.

Argos Soditic acquires ASC International House

Argos Soditic has completed the MBO of Swiss education provider ASC International House.

HgCapital acquires Qundis Group for €160m

HgCapital has acquired a majority stake in Qundis Group, a German provider of submetering devices and systems for consumption-dependent billing of heat and water, alongside other institutional clients of HgCapital.

Sagard buys Stokomani from Advent

Sagard Private Equity has acquired French discount wholesaler Stokomani from Advent International, a transaction valued at €200-210m.

Ludgate backs Ignis Biomass

Ludgate Investments has injected ТЃ3.1m into Ignis Biomass, a UK-based renewable energy company, in exchange for a minority stake.

SBOs set to rebound

The recent quaternary buyout of French eyewear retailer Alain Afflelou by Lion Capital for an estimated €780m shows that the "pass-the-parcel" trend in private equity has not yet abated.

Montagu acquires CAP

Montagu Private Equity has bought Leeds-based CAP, a provider of information to the automotive industry, for an estimated ТЃ175m.

Langholm acquires Purity Soft Drinks in MBI

Langholm Capital has backed Gary Nield and Peter Unsworthтs management buy-in of Purity Soft Drinks from long-time owners the Cox family.

Lion Capital buys Alain Afflelou

Lion Capital has entered exclusive talks to acquire French eyewear retailer Alain Afflelou from Bridgepoint, Apax France and Altamir Amboise in a deal believed to be valued at nearly €800m.

Caird Capital exits Bifold to LDC for £85m

Caird Capital has exited gas pumps manufacturer Bifold Group to LDC in a ТЃ85m deal yielding a 3x return for the seller, according to a source close to the deal.

Terra Firma buys Four Seasons for £825m

Terra Firma has acquired British elderly and specialist care provider Four Seasons for ТЃ825m.

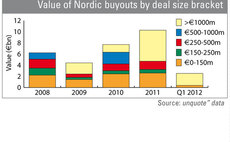

Nordics see strongest first quarter since Lehman

Despite reputational, regulatory, and macroeconomic concerns lingering from the second half of 2011, the Nordics has experienced its strongest first quarter since Lehman Brothers collapsed and brought the global economy to its knees.

Nordics seen as investment safe haven

The тЌ1.8bn sale of Ahlsell to CVC Capital Partners in February drew renewed attention to the thriving Nordic buyout market.