Early-stage

VC firms invest $50m in Owlstone Medical

Horizons also took part in the first phase of the funding round that was led by Aviva Ventures

Vitruvian leads $50m series-E for Darktrace

Other participants in the round include existing investors KKR and TenEleven Ventures

Fund+ leads €21.3m series-B for Minoryx Therapeutics

Several previous backers and new investors SFPI, SRIW and Sambrinvest also take part in the round

Accel leads $22m series-B for Snyk

Other participants in the funding round include GV, Boldstart Ventures and Heavybit

Cherry Ventures backs Hedvig in SEK 30m round

Latest capital investment is intended to help promote the startup's growth as it develops its software

Sequoia, CapitalG lead $225m series-C for UiPath

Funding was co-led by existing investor CapitalG with new investor Sequoia Capital joining the round

CapMan-backed Digital Workforce raises €3m

Investors in the round include CapMan Growth Equity Fund and earlier seed investors

Dawn, DN Capital leads $15m series-A for Divido

Deal marks the first investment for Dawn Capital since closing its $235m fund Dawn III

Calculus Capital leads £6m round for Arecor

Albion Capital and Downing Ventures also take part in the funding round

NVM leads £3.2m round for Ridge Pharma

GP contributes ТЃ2.75m towards the funding round for the UK-based pharmaceutical business

Moira Capital invests €16m in BioFlyTech

Investment will be structured as an initial €6m capital injection followed by €10m to deploy in 2019

Vesalius backs Forendo Pharma in €4m round

Additional funding comes after a тЌ12m series-A financing in 2014 and тЌ5.7m of R&D loans

Sixth Element leads £4m series-A for Azeria

Company plans to use the fresh capital to advance its research towards clinical trials

Evox Therapeutics raises £35.5m series-B

New backers include Redmile Group, GV, Cowen Healthcare Investments and Panacea Healthcare Venture

Lansdowne et al. in £25m series-B for Genomics

US-based drug developer Vertex Pharmaceuticals led the funding round for the genetic data researcher

Longitude leads £25m Kandy Therapeutics series-C

Recently founded biotech company will advance its menopause drug to the testing phase

Blockchain startup Dfinity attracts $102m round

Startup, which uses blockchain for cloud computing, already raised $61m earlier this year

Aslanoba Capital et al. back Colendi

Turkey- and UK-based VC firms inject $2.5m into the Zug-based credit scoring platform

Almi Invest backs Beactica

Funds raised are intended to accelerate the drug developer's pipeline of novel cancer therapeutics

Speedinvest leads €1.7m seed round for Kodit.io

Company is seeking to scale its operations across Europe and raise additional capital

Balderton leads $12m series-A for Simple Feast

Funding will enable Simple Feast to develop its delivery concept and go global

Maki backs Altum in series-A funding round

Existing investor Lifeline Ventures also takes part after backing a seed round in 2016

Scania invests SEK 35m in Corebon

Funding marks the fourth investment by the VC investor's corporate venture capital fund

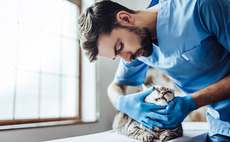

HTGF backs seed round for Adivo

Corporate investors Occident Group and MorphoSys are also taking part in the round