Exits

Axa PE sells Aixam Mega to Polaris Industries

Axa Private Equity has exited its majority stake in France-based commercial vehicles manufacturer Aixam Mega in a trade sale to US-based company Polaris Industries Inc.

LDC sells kidsunlimited for £45m

LDC has sold day care nurseries operator kidsunlimited to employer-sponsored childcare provider Bright Horizons for a cash consideration of ТЃ45m.

N+1 receives dividend recap payout from Mivisa

Spanish GP N+1 has received €21.8m as part of a dividend recap from canning company Mivisa Group.

Eurazeo PME buys Idéal Résidences from LBO France

Eurazeo PME has acquired French medical and social healthcare provider Idéal Résidences from LBO France.

CM-CIC and IDI exit Alti in €75m trade sale

CM-CIC LBO Partners and IDI have sold French IT engineering firm Alti to a subsidiary of Indian conglomerate Tata in a €75m all-cash transaction.

Axa PE sells Duplomatic Oleodinamica to Progressio

Axa Private Equity has sold Italian industrial supplier Duplomatic Oleodinamica in a secondary buyout to Progressio SGR.

Labco: formal bids expected next month

3i-backed medical diagnostics company Labco formally launched its sale process at the end of January and first bids are expected in May.

Segulah sells Medstop to Oriola-KD

Segulah has agreed to sell Medstop Group Holding AB to Oriola-KD Holding Sverige AB for SEK 1.46bn.

TPG mulls listing of Grohe Group

TPG-backed Grohe Group, a supplier of bathroom and kitchen products, is considering an IPO after a lengthy nine-year holding period.

Silverfleet buys Ipes from RJD for £50m

Silverfleet has acquired fund administration business Ipes from RJD Partners for ТЃ50m.

Enterprise makes 9x on Kruk

Central European investor Enterprise Investors has fully exited its investment in Kruk after a 10-year holding period.

Nordic Capital buys Unifeeder from Montagu Private Equity

Nordic Capital has agreed to acquire Danish logistics company Unifeeder from Montagu Private Equity in a transaction believed to be worth around тЌ400m.

CVC to list shares in bpost

CVC Capital Partners plans to list its shares in Belgian postal service bpost on the stock market and has already appointed banks to coordinate the sale, according to reports.

Ratos exits Svenska Nyhetsbrev to Bonnier

Ratos-backed Bisnode has sold business news supplier Svenska Nyhetsbrev AB to Bonnier Business Press.

Portobello Capital's Stock Uno buys CTC from Suma

Stock Uno, a logistics firm owned by Portobello Capital, has wholly acquired CTC Externalización, an outsourcing industrial and logistics services provider backed by Suma Capital.

Charterhouse and CVC's Ista receives second round bids

Charterhouse and CVC Capital Partners are receiving second round bids for German energy-metering firm Ista, in an auction that could fetch €3bn, according to reports.

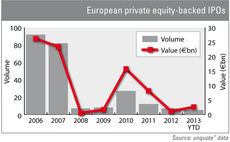

IPO activity dwarfs 2012 after first quarter

Private equity-backed IPOs are making a major comeback and could be set to reach their highest level since 2010, according to figures from unquoteт data.

Cisco buys venture-backed Ubiquisys for $310m

Small cells developer Ubiquisys, a portfolio company of Advent Venture Partners, Accel Partners and Atlas Venture, has been bought by US corporate Cisco for $310m.

Ratos and Litorina exit BTJ Group

Ratos and Litorina are set to sell BTJ Group AB to Per Samuelson, chairman of the company's board.

Capman sells Cardinal Foods to Capvest and a trade player

Capman has sold its 49% stake in Norwegian poultry and eggs producer Cardinal Foods to London-based private equity firm Capvest following at least two unsuccessful attempts at listing the business.

GCP buys Fishawack for £13m

Growth Capital Partners (GCP) has acquired international medical communications company Fishawack for ТЃ13m.

Bridgepoint acquires Oasis Healthcare from Duke Street

Bridgepoint Capital has acquired UK-based private dental healthcare provider Oasis Healthcare in a ТЃ185m secondary buyout from Duke Street.

ECI bags Amber Travel in £50m SBO

ECI Partners has acquired rail tour business Amber Travel in a ТЃ50m secondary buyout.

KKR close to €650m SMCP deal

US buyout giant KKR is in talks to buy French clothing brands Maje, Sandro and Claudie Pierlot – regrouped under the SMCP holding – for €650m, according to media reports.