Deals

The Bolt-Ons Digest – 17 October 2022

Unquoteтs selection of the latest add-ons with Equistone's Ligentia, Bridgepoint's Infinigate, Ambientaтs Namirial and more

Advent to merge Caldic with Wilbur-Ellis' Connell

Focused on nutrition, pharma, and industrial formulations, group aims to expand in APAC, LatAm

Vitruvian reignites exit plans for aviation data firm OAG

Sponsor expected to hire advisors in the next months for sale of asset held since 2017

Oakley Capital to partially exit Wishcard to IK, EMZ

Sale of German gift cards group sees founding management regaining majority position

Siparex exits Le Temps des Cerises in management-backed SBO

Trocadero Capital, Turenne and Smalt Capital join apparel brand as minority investors

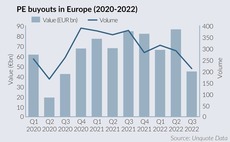

Private equity buyouts hit lowest point since COVID

Amid macro uncertainty, sponsors see EUR 44.6bn deployed across 211 buyouts, in the lowest mark since Q3 2020

Volpi kicks off fund III deployment with Xalient buyout

Tech GP says specialist focus gave edge in competitive sale; will grow cybersecurity group with M&A

Aurelius exits Briar Chemicals to trade for EUR 83m

Fine chemicals group to become part of Safex Chemicals India's European business

Graphite weighs Compass Fostering exit advised by Harris Williams

Sale unlikely to launch soon given downturn in children fostering services space

Graphite Capital buys Digital Space from Horizon Capital

IT services business sold to UK-based mid-market sponsor in an SBO

YFM reaps 4x-plus return in Springboard sale to US trade

Acquisition of footfall data analytics group will expand MRI Softwareтs retail solutions offering

Palatine exits Acora at 3x-plus money in sale to LDC

GP sells minority stake after less than three years invested in the IT managed services provider

Silverfleet to reap 3.1x money from TrustQuay sale to Hg

Exit of UK-based software provider set to generate 40%-plus IRR; Baird advised on auction

Novalpina fund exits Laboratoire XO to Stanley Capital

French drug maker is the first divestment from liquidated fund Novalpina I, now managed by Berkeley Research Group

Assietta Private Equity preps Naturalia Tantum exit

Equita and Houlihan Lokey hired for upcoming sale of Italian natural cosmetics group

Green Arrow sells Somacis Graphic in SBO to Chequers

Sale of Italian printed circuit boards marks second exit of Milan-based GP’s Fund 3

Corsair-backed IDNow halts sale plans amid valuation gap

Informal talks held with potential bidders in the summer; EUR 60m debt line arranged last month

DPE raises EUR 708m continuation fund for two IT consultancies

German GP’s new vehicle backed by AlpInvest, HarbourVest Partners and Pantheon Ventures

HIG explores sale of Germany-based HCS Group

Rothschild retained to test market appetite for hydrocarbon and specialty solutions supplier

MCF Corporate Finance buys Cubus in debt advisory expansion

Deal with Frankfurt-based firm follows demand for combined M&A and financing services

Stirling Square buys Eurofins Digital Testing for EUR 220m

Mid-market GP is deploying 2020 Fun IV in primary carve-out from French laboratories company

GENUI explores Labor Team W exit just a year after labs group buyout

Rothschild hired to assess options after Swiss asset attracted inbound interest from trade

Vaaka Partners preps Unisport exit, Deloitte mandated

Nordic sports facility surfaces and equipment company could attract large European peers

Investindustrial acquires majority stake in Eataly

EUR 200m investment will allow high-end food retailer retire debt and support global expansion