Private equity buyouts hit lowest point since COVID

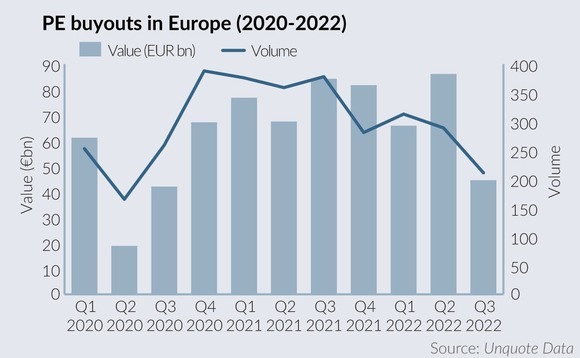

Private equity firms deployed the lowest amount of capital in Q3 2022 in Europe since COVID-19 struck, as tightening debt markets and a widespread correction to valuations point to further fierce headwinds.

Private equity firms deployed the lowest amount of capital in 3Q22 in Europe since COVID-19 struck as tightening debt markets and a widespread correction to valuations point to further fierce headwinds.

Funds deployed EUR 44.6bn across 211 buyouts between July and September, the lowest value and volume since 3Q20, when EUR 42bn was deployed across 259 deals, Unquote Data shows. European markets have typically seen EUR 65bn-EUR 85bn worth of buyouts a quarter after markets rebounded out of lockdown.

Deployment into buyouts has nosedived, down 47% on 2Q22, largely led by a plunge in mid- and large-cap deals as sponsors continue to struggle to access affordable debt financing.

Meanwhile, fewer assets are being brought to market. GPs saw exits drop by a quarter in the year-to-August, as they increasingly opt to hold portfolio companies for longer periods, hoping the fund lifecycle can endure the wait for an uptick in valuations.

There were just 66 buyouts worth EUR 100m-EUR 1bn in 3Q22, down from 106 in 2Q22, and nine at more than EUR 1bn, half the number registered in the previous quarter.

Some processes, including Walgreen's disposal of UK chemist chain Boots, have already been called off after sponsors failed to obtain debt financing, while others, like Nordic Capital's European Dental Group and HIG's HGS Group, have appointed sellside mandates but are proceeding with caution.

GPs have stopped deploying in some sectors more than others, with consumer, leisure, plus any businesses impacted by supply chain, general and wage inflation. TMT, industrials and healthcare remain resilient with Stirling's carve-out of Eurofins Digital Testing and Bridgepoint's SBO of MiQ among deals that got over the line.

"The sector balance GP portfolios invested over the past 4-5 years may not be reflective of what's investable now," said one corporate finance advisor, adding that many portfolio make-ups will have to be adjusted to account for the post-pandemic, more economically unstable era.

Getting creative

Funds are also becoming more creative where they have deployed capital, hedging risk by co-investing with peers or LPs, on transactions where they can no longer finance alone.

Take the two biggest deals by value announced in 3Q22: KKR took control of Oakley Capital's Portuguese business-solutions group Grupo Primavera in a EUR 6.8bn all-share merger with its portfolio company Cegid that brought the vendor into the share capital, while BC Partners joined existing owner Bain Capital to co-invest in EUR 3bn Italian paper manufacturer Fedrigoni.

Depleted levels of deployment are forecast to continue throughout 2H22. Corporate finance advisors tell Unquote that many processes are recalibrating to target 1Q23 launches as sponsors wait for macro conditions to improve.

Vendors are using that time to conduct bilateral conversations with strategics and sponsors so they can fly once the window opens, while buyers are taking more time to assess due diligence and EBITDA adjustments.

The tech and healthcare sectors are expected to remain resilient and attractive areas for deployment, but the supply of assets may not be sufficient to keep volumes up for the remainder of the year, said one corporate finance advisor.

Another points to a very bleak quarter ahead: "It's a very depressing market, not much new is landing on my desk. I'm depressed."

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds