Deals

Perceva bids to turn around French mattress maker Cauval

The Torcy-based business has been under restructuring since 2008

Sovereign backs MBO of Xendo

Life sciences consultancy will undertake a buy-and-build growth strategy

KKR sells WMF to Groupe SEB for €1.59bn

Deal value is based on a purchase price of €1bn and a €565m debt package

VR Equitypartner invests in Schwa-medico

GP aims to support the business by continuing its buy-and-build strategy

Tensive raises €500,000 from Invitalia and Unicredit

State-backed VC firm Invitalia tapped its Italia Venture I fund for investment

General Atlantic acquires Argus in £1bn deal

Deal values the energy price reporting business at more than 20x EBITDA

Ambienta sells Spig to US-listed B&W

Deal leads to the withdrawal of the company’s intention to float, published in April 2016

Enterprise Investors in €170m Scitec Nutrition exit

Sale price will be paid out over two instalments, with €150m up front and €20m in 12 months

CM-CIC's Kerlink reaps €10.2m through IPO

Successful IPO brings Breton startup's capital up to total €37.1m

Privet acquires CPS from De La Rue in deal worth up to £10.1m

Cash processing company will seek to profit from operational improvements

Nazca reaps 2x on IMOncology exit

Deal marks the second divestment for the Nazca III fund, which now holds seven portfolio companies

Equistone-backed Wealth at Work bolts on Affinity

Deal marks the wealth advisory company's first acquisition under the GP's tenure

Quadrivio scores 15x on Lo Scoiattolo exit

Deal marks the sixth exit for the Quadrivio Q2 vehicle, which has reached a 0.94x DPI multiple

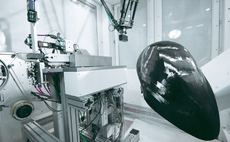

Cevotec raises €1.75m from HTGF et al.

Software business span out of Technische Universtität München last year

Intera prepares €330m listing of Kamux

Finnish used car sellerтs Helsinki IPO will give the company a market cap in тЌ275m-332m range

Deal in Focus: Astorg sells Ethypharm after nine-year holding

Resisting regular suitors, the GP's nine-year tenure of the pharmaceutical company allowed it to fully implement a long-term acquisitive strategy

CBPE acquires ABI in secondary buyout from LGV

Caravan company's management team will take a minority stake in the deal

BPI France launches €505m Eiffage share sale

Following the sale, BPI's remaining stake in the group will amount to 5.67%

Dojo Madness raises $4.5m from March et al.

Santa Monica-based March Capital Partners joins a group of European investors

Showpad secures $50m in series-C round led by Insight

Belgian tech company more than doubled its revenues for the third consecutive year in 2015

Tink raises $10m series-B from SEB Venture at al.

Investment firm Creades leads the round alongside SEB Venture and existing investor Sunstone Capital

Octopus leads $8m series-A for Stratajet

Online platform for private jet hire will explore US expansion options

Nauta Capital et al. in €6.5m series-B for BeMyEye

Backers include P101, alongside existing investor 360 Capital Partners

Polaris buys Akademikliniken from Valedo

Danish GP makes inaugural Swedish acquisition for 2015-vintage fourth fund