Deals

Maven acquires Fundamental Tracker Investment Management

Maven Capital Partners has acquired UK-based alternative asset manager Fundamental Tracker Investment Management Limited (FTIM) from City of London Group.

Isis commits £5m to Create Health

Isis Equity Partners has invested ТЃ5m in London-based fertility clinic Create Health.

Novartis, Index et al. lead €32m series-A for GenSight Biologics

Novartis Venture Fund, Abingworth, Versant Ventures and Index Ventures have co-led a €32m series-A funding round for French biotech business GenSight Biologics.

Silverfleet buys Ipes from RJD for £50m

Silverfleet has acquired fund administration business Ipes from RJD Partners for ТЃ50m.

Enterprise makes 9x on Kruk

Central European investor Enterprise Investors has fully exited its investment in Kruk after a 10-year holding period.

Nordic Capital buys Unifeeder from Montagu Private Equity

Nordic Capital has agreed to acquire Danish logistics company Unifeeder from Montagu Private Equity in a transaction believed to be worth around тЌ400m.

CVC to list shares in bpost

CVC Capital Partners plans to list its shares in Belgian postal service bpost on the stock market and has already appointed banks to coordinate the sale, according to reports.

Ratos exits Svenska Nyhetsbrev to Bonnier

Ratos-backed Bisnode has sold business news supplier Svenska Nyhetsbrev AB to Bonnier Business Press.

Harwood PE buys two music magazine brands

Harwood Private Equity has acquired the rock magazine brands Classic Rock and Metal Hammer from listed media group Future for ТЃ10.2m.

MML's Arena Group acquires Karl's

UK-based events business The Arena Group, a portfolio company of MML Capital Partners, has acquired its US competitor Karlтs Event Services.

Qualium to re-inject €30m into Quick as part of amend-and-extend

French investor Qualium is set to invest a further €30m of equity in restaurants chain Quick while the company's lenders have agreed to extend the terms of its debt, which was due to mature in 2015.

Sentica in Citec bolt-on

Sentica Partners portfolio company Citec Group has acquired French oil & gas engineering consultancy Akilea Engineering.

Kernel Capital et al. back Zinc Software

Kernel Capital and Dublin Business Innovation Centre have invested тЌ650,000 in Zinc Software, a Dublin-based company developing a biofeedback platform for iOS and Android systems.

Principia and Vertis invest $6m in Jusp

Italian VCs Vertis and Principia have made a capital injection of around $6m into Jusp, a mobile payments systems provider.

Portobello Capital's Stock Uno buys CTC from Suma

Stock Uno, a logistics firm owned by Portobello Capital, has wholly acquired CTC Externalización, an outsourcing industrial and logistics services provider backed by Suma Capital.

Charterhouse and CVC's Ista receives second round bids

Charterhouse and CVC Capital Partners are receiving second round bids for German energy-metering firm Ista, in an auction that could fetch €3bn, according to reports.

France Telecom moves forward on EE sale

France Telecom has reportedly hired banks to advise on the dual-track sale process of mobile operator Everything Everywhere (EE), which attracted private equity interest last summer.

FSI et al. in €28m round for SuperSonic Imagine

A consortium of investors, led by the Fonds Stratégique d'Investissement (FSI) and comprising several European venture players, has provided ultrasound systems developer SuperSonic Imagine with a €28m round of funding.

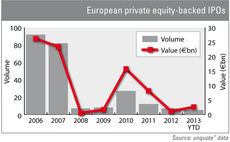

IPO activity dwarfs 2012 after first quarter

Private equity-backed IPOs are making a major comeback and could be set to reach their highest level since 2010, according to figures from unquoteт data.

Cisco buys venture-backed Ubiquisys for $310m

Small cells developer Ubiquisys, a portfolio company of Advent Venture Partners, Accel Partners and Atlas Venture, has been bought by US corporate Cisco for $310m.

Ratos and Litorina exit BTJ Group

Ratos and Litorina are set to sell BTJ Group AB to Per Samuelson, chairman of the company's board.

Astorg seals Areva unit purchase

French GP Astorg Partners and energy company Areva have signed an agreement for the takeover of Canberra, Areva’s US-based nuclear measurement subsidiary.

Iris and Isai inject €2m into InstantLuxe

French venture capital firms Iris Capital and Isai have provided online marketplace InstantLuxe.com with a €2m round of funding.

Capman sells Cardinal Foods to Capvest and a trade player

Capman has sold its 49% stake in Norwegian poultry and eggs producer Cardinal Foods to London-based private equity firm Capvest following at least two unsuccessful attempts at listing the business.