Deals

Greencoat Capital leads £6.75m round for Aveillant

Greencoat Capital has led a ТЃ6.75m funding round for UK-based radar technology developer Aveillant.

PE-backed Hofmann bolts on Posterjack

Hofmann, a Spanish photo album specialist backed by Realza Capital and Portobello Capital, has acquired German customised printing company Posterjack.

LitCapital et al. back Baltic Bicycle Trade

LitCapital and German firm Panther International have invested $1.8m in Lithuania-based electric bicycle company Baltic Bicycle Trade.

Highgrowth sells Facomsa stake to Prudential Tradelink

Spanish VC investor Highgrowth has sold its 35% stake in automotive components manufacturer Facomsa in a trade sale to Prudential Tradelink.

BNP Paribas et al. invest in Systar

Systar, a French provider of operational intelligence software, has completed a €2.35m private equity offering.

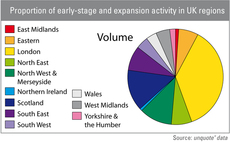

London & Scotland see most growth investment

In 2012, the UKтs venture and growth capital scene was once again most active in London, where unquoteт data recorded 82 transactions with a combined value of ТЃ734m.

NVM exits Interlube Systems in trade sale

NVM Private Equity has sold British automated lubrication producer Interlube Systems to a subsidiary of The Timken Company, reaping a money multiple of 3x.

3i and RCP exit Giraffe to Tesco

3i and Risk Capital Partners (RCP) have sold their 36.8% stakes in UK-based restaurant chain Giraffe to Tesco, giving the business a ТЃ48.6m enterprise value.

HTGF, eCapital et al. invest €3.3m in Saperatec

A consortium led by eCapital entrepreneurial Partners and including High-Tech Gründerfonds (HTGF), Gründerfonds Bielefeld-Ostwestfalen, NRW Bank and a business angel, has invested €3.3m in German recycling business Saperatec.

Latour Capital buys Oxand

Latour Capital has taken a majority stake in the buyout of Oxand, a French engineering and consulting firm specialised in the risk-based management of industrial infrastructure.

GCP backs Scopus Engineering with £13m

Growth Capital Partners (GCP) has invested ТЃ13m in Scopus Engineering, a Scottish provider of laser survey services to the global oil & gas industry.

Endless reaps 6x on Acenta Steel exit

Endless has sold its stake in UK-based steel bars processor Acenta Steel to the company's management, reaping a return of 6x its original investment.

EdRip and BNP Paribas to back RBI spinout

Edmond de Rothschild Investment Partners (EdRip) and BNP Paribas Développement have entered exclusive negotiations to back the management buyout of French media group Reed Business Information (RBI) from its parent company Reed Elsevier.

unquote" Regional Mid-market Barometer

A rise in alternative lenders and a strong trade buyer presence helped drive the UKтs mid-market in 2012, according to the latest unquoteт Regional Mid-market Barometer, published in association with LDC.

RJD's Harrington Brooks acquires customer books in bolt-on

RJD Partners portfolio company Harrington Brooks has acquired customer books from Carrington Dean and The Nostrum Group, marking the company's first expansion following its secondary buyout in July 2012.

Vendis backs Alexandre de Paris

Vendis Capital Management has taken a stake in the buyout of French hairdressing salon and cosmetics company Alexandre de Paris, in what marks the GP's first investment in France.

Fouriertransform backs TitanX

State-owned venture capital firm Fouriertransform AB has agreed to invest SEK 185m in Swedish automotive company TitanX Engine Cooling, which is also backed by EQT.

Maven sells Homelux to QEP Company

Maven Capital Partners has sold tile accessories business Homelux to US firm QEP Company, following its carve-out from UK-based Homelux Nenplas Ltd.

Omnes et al. in €10m round for EyeTechCare

Returning backer Omnes Capital has taken part in a €10m series-C round of funding for French medical devices developer EyeTechCare.

Finance Wales backs Safety Technology

Finance Wales has provided Monmouthshire-based safety specialist Safety Technology with a six-figure loan.

LDC backs Fever-Tree

LDC has taken a 25% stake in Fever-Tree, valuing the UK tonic water and mixers brand at ТЃ48m.

Oxford Capital exits Arieso to JDSU

Oxford Capital Partners has sold UK-based mobile network optimisation specialist Arieso to Nasdaq-listed JDSU in a $85m deal.

CVC sells further shares in Evonik ahead of IPO

CVC and Rag Foundation have sold a further 4.6% stake in German chemicals business Evonik, reducing their stakes by around 6% each in total, ahead of a renewed attempt at listing the business.

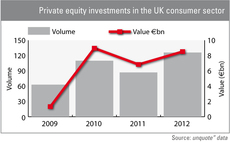

UK consumer sector: private equity dealflow up 45% in 2012

High street woes notwithstanding, the UK consumer sector proved to be ripe for investment opportunities last year: private equity dealflow was up by 45% compared to 2011 figures while the overall value of these investments rose by a quarter.