Deals

Nordic buyouts set to return to 2007 levels

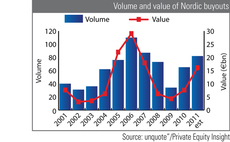

Buyout activity in the Nordics could return to levels seen in 2007, according to unquoteт research. If Nordic deal activity continues at the pace seen in the first half of 2011, volume and value look set to fall just short of 2007 levels, marking a resurgence...

Newcomer DTI makes debut UK investment

New York-based DTI Capital has backed the ТЃ4m buyout of London-based WTG, unquoteт has learned.

Sponsor Capital et al. sell Lujapalvelut

Sponsor Capital, Varma and other shareholders have sold Finnish facility management company Lujapalvelut Oy to Coor Service Management.

Industrifonden et al. invest SEK 9m in SEEC

Industrifonden, STING Capital and ALMI Invest have invested SEK 9m in SEEC, a company that develops, markets and sells energy stores with energy modules for large buildings.

Palamon exits cadooz to Euronet

Palamon Capital Partners has sold provider of vouchers and reward systems cadooz to Euronet, a US-based provider of electronic payment solutions.

Perusa Partners buys Bactec

Private equity house Perusa Partners has acquired explosive ordnance contamination service provider Bactec.

Explorer in talks to acquire Inspecentro

Portuguese buyout house Explorer Investments is contemplating the acquisition of the entire share capital of motor vehicle inspection company Inspecentro.

LBO France and LFPI Gestion close Eminence SBO

LBO France and LFPI Gestion have acquired men's underwear manufacturer Groupe Eminence from Orium and Pechel Industries Partenaires.

The unquote" forecast: Buyout activity approaches 2008 levels

Propped up by a strong third quarter, European buyout activity should exceed the overall value invested in 2008 by the end of this year, but may fall short volume-wise. Greg Gille reports

Creathor Venture invests in Shopgate

Creathor Venture has invested in online retail platform Shopgate with an undisclosed amount between €1-5m.

Triton-backed Talis adds Raphael Valves

Triton portfolio company Talis has acquired valve manufacturer Raphael Valves Industries from Tyco International.

Exponent in £121m BBC Magazines buyout

Exponent Private Equity has purchased BBC Worldwideтs consumer magazine business BBC Magazines for ТЃ121m.

JPEL buys Arch Cru portfolio for £56.5m

J.P. Morgan's Private Equity fund of funds (JPEL) has snapped up 38 investments from the former Arch Cru portfolios in a deal worth ТЃ56.5m.

Cinven buys Guardian from Aegon

Cinven has acquired UK life and pensions provider Guardian Financial Services from Aegon for ТЃ275m.

Permira sells Provimi for €1.5bn

Permira has reached an agreement to sell Dutch animal food producer Provimi to Cargill for €1.5bn.

Investindustrial pours water on Ducati sale speculation

Investindustrial has poured water on speculation that it is planning to float Italian motorcycle business Ducati in Hong Kong next year.

Bridgepoint exits Protocol Education

Bridgepoint has sold Protocol Education, part of its portfolio company Protocol Associates, to Graphite Capital.

ECI buys Wireless Logic for £38m

UK mid-market investor ECI Partners has backed the management buyout of Wireless Logic from Dragonsт Den entrepreneur Peter Jones for ТЃ38m.

FII et al. invest €2m in Multitouch

Finnish Industry Investment (FII) and Veritas Pension Insurance have invested тЌ2m in Finnish interactive display developer Multitouch Ltd.

LDC invests £12m in WRG

LDC has invested ТЃ12m in Salford-based live events and marketing agency WRG.

UK activity surges in July after slow start

Following a rather lacklustre start to 2011, the UK has seen a sudden spike in private equity investment activity this summer, and professionals will be hopeful this can continue through the rest of the year.

bmp leads finance round for iversity

bmp and Frühphasenfonds Brandenburg have completed a first round of funding for software company iversity, worth more than €1m.

Quadriga acquires Kinetics

Private equity house Quadriga Capital has acquired Kinetics Germany from US-based Kinetic Systems.

Fondo Italiano acquires 25% of TrueStar

Fondo Italiano has acquired a 25% stake in TrueStar Group, an Italian company that offers baggage wrapping services at airports.