Buyout

Nordic Capital cuts LBO fund target by 25%

Nordic Capital has told investors it will cut the original тЌ4bn target of its latest leveraged buyout fund by 25%, according to reports.

Baring Vostok raises $1.5bn for fifth fundraising effort

Baring Vostok has held a final close for Baring Vostok Private Equity Fund V LP and Baring Vostok Fund V Supplemental Fund LP, raising a total amount of $1.5bn.

BPE 3 holds first close at €55m

BPE's third fund, BPE 3, has held a first close on €55m.

Montefiore hits €180m target for third fund

French mid-cap GP Montefiore Investment has raised €180m for its third fund and is still raising the vehicle beyond its initial target.

Blackstone closes $2.5bn energy fund

Blackstone has held a final close for its first energy-focused private equity fund, Blackstone Energy Partners (BEP), on $2.5bn.

DN Capital holds first close on €51.5m

DN Capital is reported to have held a first close of DN Capital GVC III on тЌ51.5m.

Apollo looking to raise up to $12bn

Global private equity house Apollo Global Management is planning to raise $10-12bn for its next buyout fund, according to reports.

NorthEdge hits £125m first close

Manchester-based lower mid-market investor NorthEdge Capital has hit a first close on ТЃ125m for its maiden fund, according to sources close to the firm.

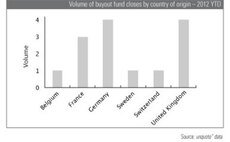

Competition heats up for German fundraising

Deutsche Beteiligungs AG (DBAG) last week closed Germany’s biggest fund since 2007. While the country’s fundraising environment has been paid little attention in recent years, it has seen as many fund closes in 2012 as the UK. John Bakie investigates...

Main Capital holds €12m first close for third fund

Main Capital Partners has held a €12m first close for its Main Capital III fund, launched in September 2011.

DBAG VI hits €700m hard cap

Deutsche Beteiligungs AG (DBAG) has closed its sixth fund at €700m, breaking its target and reaching its hard cap.

Inflexion closes £100m co-investment fund

Inflexion Private Equity has closed its 2012 Co-Investment Fund on its ТЃ100m hard cap, six weeks after sending out PPMs.

Equita CoVest in €115m first close

Equita Management has held a €115m first close for its Equita CoVest fund.

RiverRock closes European SME fund on €169m

RiverRock European Capital Partners has announced the final close of its European Opportunities Fund on тЌ169m.

Bain kicks off fundraising for new $6bn vehicle

Bain Capital is understood to have started the fundraising process for its 11th buyout fund, Bain Capital Fund XI.

Latest DBAG fund holds €451m first close

Deutsche Beteiligungs AG has held a first close on €451m for its mid-market buyout fund DBAG Fund VI, two months after sending out PPMs.

ECM closes fourth fund on €230m

ECM Equity Capital Management has announced the final close of its fourth fund, GEP IV, on €230m.

Procuritas closes fifth fund on €200m

Procuritas has closed its fifth investment vehicle on тЌ200m.

Siparex closes MidCap II fund on €130m

Siparex has held a €130m final close for the Siparex MidCap II vehicle.

Vista Equity Partners closes fourth fund on $3.5bn

American GP Vista Equity Partners has held a $3.5bn final close for VEP Fund IV.

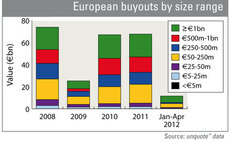

Buyout market could see worst year since 2009

Latest figures show Europe's buyout market has failed to recover from the market malaise of late 2011, brought on by the Eurozone crisis, particularly at the upper end of the market.

Buyout market could see worst year since 2009

Latest figures show Europe's buyout market has failed to recover from the market malaise of late 2011, brought on by the Eurozone crisis, particularly at the upper end of the market.

Dry powder will drive 2012 dealflow - Bain

Extensive dry powder, few exit opportunities and tough fundraising conditions will be the major drivers of private equity globally, according to Bain & Company.

Belgian, Chinese sovereign funds to launch joint vehicle

China Investment Corporation (CIC) is launching a small fund to help domestic companies make investments in Europe in partnership with Belgian Federal Holding Company and A Capital.