Funds

Qualitas launches €200m fourth fund-of-funds

Qualitas Funds IV invests in fund managers operating across the lower-mid-market in Europe and North America

Italian GP Arcadia to start marketing new fund by end of 2021

Arcadia's third fund will be larger than its predecessor, which closed on €80m in 2019

Agilitas 2020 Private Equity closes on €565m

Fund focuses on mid-market companies across western Europe, within a range of sectors

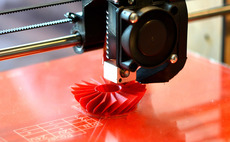

AM Ventures holds first close for 3D printing venture fund

Additive manufacturing-focused venture capital firm has a target of €100m for the vehicle

Iron Wolf Capital eyes €30m-plus fund launch after 2023

Baltic venture capital investor raised €21m for its first fund in 2019

Saga holds first close on €600m for eighth fund

GP started raising its latest fund in late September 2020 and plans to continue fundraising into Q2 of 2021

FII to launch €700m Agritech & Food Fund

Fund invests in companies across the food and agriculture sectors to boost their growth and technological development

Sofinnova Crossover Fund closes on €445m

Fund focuses on investments in later-stage biopharma and medtech companies that need capital to scale up

Beyond Black holds first close for Pledge Fund I

Following the тЌ20m first close, the Berlin-based VC aims to launch a larger cleantech-focused fund

2150 holds first close on €130m for debut fund

It plans to back 20 companies, offering equity cheques of up to тЌ40m across the life of an investment

Tikehau closes T2 Energy Transition Fund on €1.1bn

Fund targets European companies operating in the clean energy production, low-carbon transport and energy efficiency segments

Skylake Capital holds first close, makes first deal

Debut fund leads a $3m round in UK-based deep-learning startup Mindtrace

Afinum back on road for ninth fund

Predecessor vehicle, which raised €410m in 2017, is now 86% deployed

Advent Life Sciences raises $215m across two new funds

Funds invest in early- and mid-stage life sciences companies developing new therapeutics and technologies

Itago IV holds €60m first close, buys SR-Mecatronic

Fund inks its first deal by acquiring a majority stake in Italian business SR-Mecatronic

Passion Capital closes venture secondaries deal

Fund closed in 2011 on ТЃ37.5m but now boasts a NAV north of ТЃ100m

Five Seasons launches second fund

VC targets the European food technology industry, primarily investing in series-A and -B rounds

Hamilton Lane Closes fifth secondaries fund

This is the largest fund to date for Hamilton Lane, exceeding the vehicle's $3bn target

Flashpoint holds $70m first close for new venture secondaries fund

GP is targeting $200m for its new strategy, and its co-founders will commit 10-15% of their own capital to the fund

Schroder Adveq registers fourth secondaries fund

Both a US dollar-denominated and a euro-denominated vehicle have been registered

Altamar launches €120m debt fund-of-funds

Altamar Private Debt III plans to target both direct lending funds and senior loan vehicles

Ufenau to target €800m for next vehicle

Swiss GP plans to launch Fund VII in mid-2022, according to managing partner Ralf Flore

Eurazeo Smart City II Venture holds €80m first close

Fund invests in energy, transport, property technology and logistics startups worldwide

Golding Buyout 2018 holds final close on €375m

Golding Capital expects to begin fundraising for its next buyout-focused fund-of-funds in H2 2021