Funds

Finch holds first close for third European fintech fund

New fund is targeting тЌ150m and will double down on AI-enabled fintech companies in Europe

Genesis closes first growth fund on €40m hard-cap

Vehicle was launched in May 2018 and held a first close in October 2019

Eurazeo receives €340m in commitments for growth continuation fund

Investors commit to a newly created continuation fund that will acquire a 32% stake in Eurazeo Growth

Abingworth Bioventures 8 closes on $465m

ABV 8 targets companies developing innovative therapeutics, with investments across the US, UK and continental Europe

PSG closes debut European fund on €1.25bn

PSG Europe invests in lower-mid-market software and technology-enabled services companies

Siena Venture targets €25m close before year-end

Debut fund from the new VC player held a first close on 1 February

Capza launches €500m Expansion Fund

Fund combines investments in equity, quasi-equity and a wide range of non-dilutive financial instruments

Q-Impact Fund increases target to €50m

Q-Impact invests in companies able to provide a positive and measurable social and environmental impact

Verdane exceeds target for second Edda fund; closes on €540m

Fund exceeded its target of тЌ450m by тЌ90m and was "significantly" oversubscribed

Lauxera Growth I holds €100m first close

Fund is dedicated to financing and accelerating the commercial growth of promising healthtech companies

Sinergia Venture Fund holds €30m first close

Fund invests in pre-series-A and series-A rounds to support the growth of startups operating across a large variety of sectors

Octopus to launch £100m healthcare-focused fund

In conjunction with the announcement, the firm has hired an investment team from TenX Health

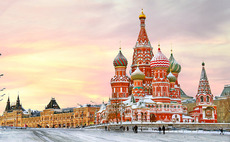

Elbrus holds first close on $260m for third fund – report

Fund has a target of $600m, which it plans to reach by next year, according to Kommersant

Coller Capital closes $9bn secondaries fund

CIP VIII's predecessor vehicle closed on $7.15bn in December 2015

Blue Horizon Ventures closes debut fund on €183m

Food-technology-focused VC was founded in 2018 and has so far made 18 investments

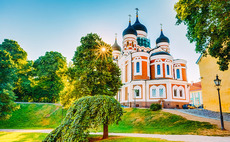

New Baltic fund targets €30m to back female founders

Fund targets Baltic and Nordic startups with female founders and gender-balanced executive teams

Heal Capital closes debut fund on €100m

Healthtech-focused VC sees opportunities in the developing European market, managing director Christian Weiß tells Unquote

Volpi II closes on €323m

Founder Crevan O'Grady discusses the process and strategy with Katharine Hidalgo

LSP launches €150m fund dedicated to dementia treatment

Vehicle invests in companies that are developing drugs for neurodegenerative diseases

Idea Agro closes on €110m

Fund targets the Italian agriculture industry across its entire value chain, with a focus on sustainability issues

Investec holds first close for PDF I on €165m

Investec has originated more than тЌ5bn in loans across 200 transactions in the last decade

Volpi II closes on €323m

Volpi secured backing from existing investors, as well as new European and US-based institutions

Anima Alternative 1 holds €117m first close

Fund intends to provide flexible financing solutions for the medium- and long-term needs of Italian SMEs

Patron closes sixth fund on €844m

Patron Capital VI is a closed-ended Jersey-based Limited Partnership, while Patron is based in London