Funds

Inveready launches new ICT fund, closes biotech vehicle

VC house also closes its Inveready Biotech III fund, after just three months on the road

Lyceum spinout Horizon launches £200m fund

Established by former Lyceum management team members, Horizon Capital is launching a new fund

Ananda raises €50m for third fund

Main LPs in the latest fund include the European Investment Fund, along with Big Society Capital

Dunas Capital launches first fund-of-funds

Madrid-based Dunas Capital has launched its first fund-of-funds, Rainforest Dunas Iberia Fund I, with a €100m target.

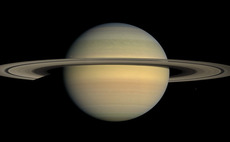

Hg Saturn holds final close on £1.5bn hard-cap

Software-dedicated vehicle is already 40% deployed across investments in Visma and Iris

Cibus Fund receives Guernsey Green Fund status

Guernsey Financial Services Commission launched the Guernsey Green Fund initiative in July 2018

Quadrille holds €200m first close for new tech fund

Fund is larger than its predecessor, Quadrille Technologies III, launched with a €100m target

Corviglia holds first close on $250m

Vehicle was registered in Luxembourg in July 2018 and is targeting a final close on $500m

Stride.VC closes £50m seed fund

Firm simultaneously announces the appointment of former LGT Impact head of finance Arjuna Soysa

Skandia raises SEK 180m for fund-of-funds

Vehicle was launched in January 2018, with approximately the same target as Thule Buyout Fund II

Adams Street closes early-stage fund-of-funds on $426m

Firm has committed to more than 200 European primary funds since opening its London office in 1996

Epiris holds £821m final close

GP's first fund as an independent manager has surpassed its ТЃ800m target after 18 months on the road

Fuel Ventures raises £20m

Early-stage investment company was launched by Myvouchercodes founder Mark Pearson

Q Group holds €100m first close for Industry 4.0 fund

GP plans to hold a final close by the end of 2019 and make its first investment in the coming months

Balderton raises $145m for direct VC secondaries fund

Fund will target European growth-stage companies where early backers want some pre-exit liquidity

Herkules spinout Equip prepares fund launch

Former managing partner Sverre FlУЅskjer is leading the spinout under the name Equip Capital

Q Group launches Made in Italy fund, inks first deal

Made In Italy Fund was launched with a €200m target and has already acquired Palladium Moda

Forbion exceeds initial cap with €360m final close

Forbion IV significantly surpasses the size of its €183m predecessor Forbion III

Keensight launches fifth fund with €750m target

Vehicle will follow strategy of predecessor, backing companies with revenues of €15-250m

Mérieux holds first close for MP3

Merieux Equity Partners holds €200m first close for health and nutrition-focused vehicle

Newfund 2 holds final close on €130m

Newfund 2 is a significant step-up from the €72m Newfund 1 but comes short of €150m target

Inverleith holds €60m final close for maiden fund

Scottish GP was founded in 2010 by ex-Noble Group CEO Thomson and ex-L Capital partner Skipworth

Northleaf nets $2.2bn for global PE programme

Canadian private markets investor closes its latest secondaries vehicle on $800m

LBO France launches fund for high-net-worth clients

LBO France's FCPR White Caps Sélection accepts a minimum of €25,000 from high-net-worth clients