Funds

Azimut-backed Lycian heads for debut fund first close in Q1 2023

New Turkish PE could reassess investment strategy and hard cap goal after receiving backing from asset manager late last year

Carlyle private equity fundraising slumps behind peers

Sponsor remains on the road for its eighth flagship fund amid turmoil at CEO-level, with fundraising lagging behind peers KKR and EQT

Accession Capital Partners aims for autumn 2023 final close for Fund V

Sponsor has held a EUR 150m first close for its latest fund and will back Central European businesses with flexible capital

Eurazeo shakes up executive board; CEO Virginie Morgon to depart

New board members are chairmen Christophe Bavière and William Kadouch-Chassaing, as well as Sophie Flak and Olivier Millet

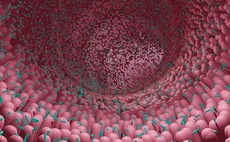

Seventure preps third generation of microbiome fund

Health for Life III to be slightly larger than EUR 250m predecessor; will invest in Europe, US, Israel

Idacapital targets close to USD 30m for impact fund

Turkish VC seeks to raise USD 5m every six months for new rolling investment vehicle

MML launches lower-mid-market strategy for UK, Northern European B2B assets

London-headquartered GP invested in AI provider MIcompany in first deal for new strategy this week

Revo Capital preps third fund for 2023 launch

VC firm aims to raise USD 75m-150m from private and public investors including blue-chip institutional LPs in Europe, MENA and US

Oakley raises EUR 2.85bn for fifth flagship fund

More than twice the size of its 2019 predecessor, the vehicle will allow for larger equity tickets, more investments and bolt-ons

Getir plans new funding round for H1 2023

Fast grocery delivery group could fetch a valuation above the USD 10bn-plus of its last round

Integra Partners heads for year-end close for EUR 250m second fund

Vehicle is open to retail investors with tickets of EUR 500,000-plus and will make fund and co-investments

BlackRock mulls new vintage of private capital products for sophisticated retail investors in Europe

Global asset manager explores new generation of private market funds for wealthy individuals banking on positive uptake from retail investors

LDC outlines plans for new record year of deployment

Despite macro woes, sponsor wants to build up on last yearтs pace of investment and exceed GBP 400m mark in 2023

Women in VC: Revaia's Albizzati on founding a female-led firm and navigating valuations in 2023

Co-founder Alice Albizzati outlines the growth equity firm's priorities as it heads for the final close of its EUR 500m Fund II

21 Invest France eyes EUR 300m Fund VI target by year-end

Fund VI has raised half of its target so far, with the GP seeking to further prove its investment track record throughout 2023

Clessidra on track for 2023 final close for debut private debt fund

GP has raised EUR 150m for the vehicle against a EUR 250m target, with one third already deployed

Ardian plans North American drive with tech, services deals on radar

French sponsor looks to more than double exposure to US and Canada when next flagship buyout fund launches

InnovaFonds gears up for first close of new SME fund

French GP’s mezzanine and small equity tickets vehicle aims to attract institutional investors and has a EUR 100m target

Presto Ventures targets EUR 100m for new early-stage fund

Czech VC seeks to attract larger institutional investors from Western Europe and US for its third vehicle

Arcano holds EUR 450m final close for latest secondaries fund

With just under 50% deployed, the vehicle will split focus evenly between LP stakes and GP-leds

Waterland raises EUR 4bn for buyout and minority funds

Flagship fund closed EUR 1bn above predecessor amid a tough fundraising environment for midcap GPs

Merito Partners targets EUR 50m for debut growth equity fund

Sponsor plans to build a portfolio of 12-18 companies, with EUR 12m in fund commitments secured to date

EQT on track for 2023 final close for Fund X

GP has so far raised more than EUR 16bn for the vehicle against EUR 20bn target

Series A rounds likely bright spots in VC investing in Q1 2023 – KPMG

Energy security, ESG deals to continue apace, with consumer-focused businesses seeing most strain