Funds

Perusa to launch third fund

Perusa Partners II held a final close on €207m in November 2011 and is deployed across 10 deals

Ardian raises €700m for first European real estate fund

Investors comprise pension funds, insurance companies and high-net-worth individuals

SwanCap holds final close on €433m

Fund will invest in primaries, direct co-investments and secondaries in Europe and North America

BNP Paribas launches venture fund

BNP Paribas Capital Partners' vehicle targets financial services and insurance startups

Pantheon aims for FTSE 250 as NAV per share rises

Pantheon also announces a share restructuring and the issue of a ТЃ200m asset-linked note

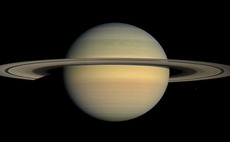

Hg launches Saturn fund

Naming convention follows Hg's Mercury series, which targeted the small-cap space

EQT VIII holds final close on €10.75bn hard-cap

New vehicle follows the Swedish GP's тЌ6.75bn seventh fund, which closed in August 2015

Goldman's Petershill raises $2.5bn for GP stakes

One LP said the strategic partnership with Goldman might boost its access to oversubscribed funds

Lexington returns to market with record secondaries raise

Lexington held a final close for LCP VIII on its $10.1bn hard-cap in April 2015

Capvis to close fifth fund on hard-cap

More than 80% of LPs reupped into the fourth fund, which closed on its €720m hard-cap in 2014

IK closes Small Cap II Fund on €550m hard-cap

Including a GP commitment of тЌ50m, the fund closed on its тЌ550m hard-cap on 15 February

Mayfair raises for second fund in US and Europe

GP makes an SEC filing listing commitments of $130m from US-based institutional investors

Capzanine to hold final close for €950m private debt fund in Q1

Launched in Q1 2017, Capzanine 4 Private Debt fund should hold a final close in March

Italian private debt issuance jumps 35% in 2017

Southern Europe's two biggest markets differ greatly in their uptake of private debt, with Spanish players facing strong competition from banks

BVI launches new LP law

BVI Finance outlines four key areas in which the new law will benefit investment funds

KKR launches Global Impact Fund

Fund will target investments with positive social and environmental impact globally

Artá Capital closes second fund on €400m hard-cap

Vehicle will invest in medium-sized Iberian companies with an enterprise value between €100-500m

Fenera to raise three funds-of-funds

Shareholders include Fenera Holding, Banca Sella and some institutional investors

iBionext closes maiden fund iBionext Growth on €90m

Backers of the fund include French and international investors, including a Chinese corporate

Essling closes second co-investment fund on €115m

Hard-cap was originally set at €100m, but was raised in order to meet increasing demand

Golding to launch new FoF in H2

Golding announces new fund after a record year of fundraising across all strategies

Artemid closes second debt fund

Launched in Q3 2017, Artemid Senior Loan II surpasses its predecessor and closes on €413m

Imbiba holds final close on £50m hard-cap

New vehicle will target investments in UK-based leisure and hospitality businesses

Scor, LBO France launch Scor Mid Market Loans fund

Asset manager Scor Investment Partners teams up with GP LBO France for a leveraged loans fund