Financing

Banks arrange debt for sale of 3i and Allianz's Scandlines

A debt package of up to €1bn is being put together for the sale of German ferry operator Scandlines, owned by 3i and Allianz Capital Partners, according to reports.

Qualium to re-inject €30m into Quick as part of amend-and-extend

French investor Qualium is set to invest a further €30m of equity in restaurants chain Quick while the company's lenders have agreed to extend the terms of its debt, which was due to mature in 2015.

DLA Piper survey highlights rise of unitranche

Unitranche financing is predicted to be the most popular form of debt funding after senior-only provision in 2013, according to a new DLA Piper survey.

German banking reform threat to private equity

The German government's draft proposals for banking reform, based on the Liikanen Report, are seen by many in the private equity industry as yet another threat from legislators, despite the unclear effect it may have on the asset class. Carmen Reichman...

Axa Private Equity arranges €220m unitranche for IPH buyout

Axa Private Equity has arranged a €220m unitranche debt facility for the secondary buyout of industrial supplies distribution company IPH by PAI partners – a transaction which saw vendor Investcorp reap a €210m windfall.

Austrian private equity market gathers momentum

Austria’s private equity scene could be on the verge of a mini-boom as January’s deal activity has already outperformed last year’s first quarter.

BVCA calls for return of taper relief

The BVCA has called for the return of the controversial taper relief for capital gains tax (CGT) in some cases.

Vendors and banks amenable to strong 2013 in UK

Good signs for 2013

Axa PE to arrange unitranche for IPH buyout

PAI partners is believed to be looking to raise a €180m unitranche facility from Axa Private Equity to finance its buyout of industrial supplies distribution company IPH.

EBRD loans RUB 1.7bn to Orient Express Bank

The European Bank for Reconstruction and Development (EBRD) has provided Orient Express Bank (OEB) with a three-year loan totalling RUB 1.7bn.

Biffa: A rubbish buyout?

A rubbish buyout?

The pitfalls of turnaround investing

Turnarounds are in the news once again, with the decision by specialist investor OpCapita to put struggling electricals retailer Comet into administration. Last week, Deloitte took over the administration of the business, and on Monday made over 300 staff...

Silicon Valley Bank provides credit to Carlyle's The Foundry

Silicon Valley Bank (SVB) has provided a new credit facility to Carlyle's software holding The Foundry.

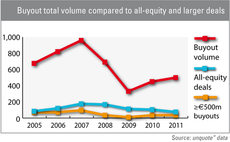

Buyout loan issuance down 38% YoY, says Baird study

European figures for leveraged and buyout loan issuance are down 46% at €20bn and 38% at €10bn respectively, according to recent research by Baird.

Escaping the equity black hole

The European M&A market continues to be depressed - as are many of the advisers in the sector. However, there are a number of tactics that interested parties and their advisers can pro-actively employ to help facilitate a transaction when it might otherwise...

Palio plans £150m debt fund IPO

Debt fund Palio is planning an IPO to raise more than ТЃ150m for investment in debt opportunities for UK lower mid-market companies.

Leveraged finance "at tipping point"

Royal Bank of Scotland, Lloyds TSB, Barclays, HSBC т all names that can be seen on high streets across Britain. From credit cards to mortgages to investment banking and acquisition finance, these powerful institutions once had the UKтs credit market tied...

Arle completes Stork refinancing

Arle has completed the refinancing of two of its portfolio companies, despite having to pull a high-yield bond issue last month.

Doughty Hanson secures £205m debt package for ASCO

Doughty Hanson has leveraged oil and gas portfolio company ASCO with a £205m senior debt package.

Moody's cuts German credit outlook

Moody's has indicated it may downgrade Germany's Aaa credit rating, which could make financing operations in Germany more difficult.

Stork high-yield refinancing postponed

Stork Technical Services, backed by Arle Capital Partners, has suspended its €315m high-yield bond issue, citing tough market conditions.

Tikehau IM and Macquarie team up for debt programme

Tikehau Investment management and Macquarie Lending's corporate and asset finance group have partnered to offer debt funding solutions to French SMEs.

Moody's forecasts €33bn+ LBO default

More than a quarter of unrated private equity LBO debt will default by 2015, according to ratings agency Moody’s.