Leveraged finance "at tipping point"

Royal Bank of Scotland, Lloyds TSB, Barclays, HSBC т all names that can be seen on high streets across Britain. From credit cards to mortgages to investment banking and acquisition finance, these powerful institutions once had the UKтs credit market tied up, able to provide seemingly infinite underwriting for any asset a borrower wished to buy.

However, the US sub-prime mortgage crisis and the chain reaction that ensued put an abrupt end to the days of easy credit. But as the large banks continue to lick their wounds, new players are stepping up to take their place. These "alternative" finance providers, once seen by some as a last resort for those who were struggling to raise funds from more mainstream lenders, have been making their presence known in the UK leveraged finance market in a big way in recent years.

"We have experienced a long credit drought which has seen the major banks struggle to continue lending as cheaply and freely as they could before," says Charlie Johnstone, director at ECI Partners. "Today, there is simply not the volume of debt around to fund the very high quality of deals that could be done in this market."

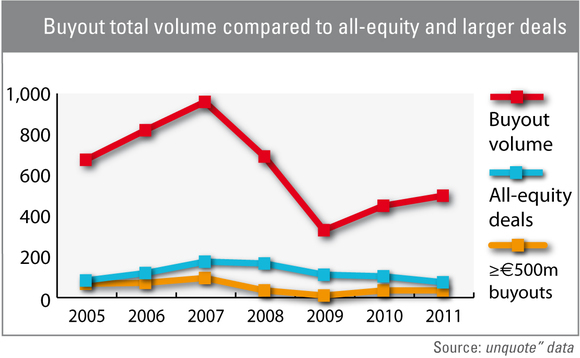

Most GPs are aware that banks are lending less than they were pre-crisis. European senior loan volumes have fallen substantially since their peak in 2007, when over €160bn was lent across more than 320 deals, according to data from Standard & Poors LCD. By contrast, in 2011 this was just a little over €40bn for some 140 buyouts. This stark contraction in debt provision has certainly left its mark, with buyout volumes also suffering, an increasing incidence of "all-equity" deals and a dearth of larger acquisitions (see graph). The number of deals valued at over €500m - those most reliant on a healthy leverage market - has dived to less than half the level seen prior to the financial crisis, with just 35 deals in 2010 and 2011, compared to over 90 in 2007.

Equally noteworthy is the growing presence of the so-called "alternative financiers". Investec and GE Capital are noteworthy for being particularly active in the UK market in the last few years, though other long-time players, such as Indigo Capital, are expanding their offerings. Ares Capital Europe made waves when it launched in 2007.

New providers are also entering the fray, and last year Deloitte UK chief executive John Connolly left the firm to become chairman of Metric Capital Partners, a new mid-market European debt provider. Palio Capital is seeking to fill the gap in the lower mid-market in the UK,with around £30m in commitments from the EIF and seeking £100m. Adding further weight to the attractiveness of debt investing in Europe, Apollo Global Management recently announced it would be focusing primarily on its credit funds in the coming months as it expects debt investments to be more profitable than private equity investing.

Investec Growth & Acquisition Finance's Gary Edwards says the UK's leveraged finance market is at a tipping point. "In the past, the term ‘alternative finance' had a negative connotation. Alternative financers were the people you would go to because the big banks wouldn't lend to you," Edwards says. "However today, people are looking for an alternative to the old debt structures. The banks just don't have the flexibility to underwrite the whole structure, from asset based lending right up to senior debt."

The use of "one stop shops" providing senior debt, mezzanine and other forms of finance, whether in a single tranche or segregated has become increasingly common in the UK market. Edwards believes Investec's ability to flexibly structure its financing is attractive to GPs and one of the major drivers behind increased take-up of alternative financing.

"When we go in, we're not only focused on where the business is now, but how it will grow in the future. In the past we have provided financing for second and third bolt-ons to make sure growth happens. The structure we provide gives the sponsor the flexibility to run the business the way they need to. They like this and we find that once they have experienced it they will keep coming back for more," says Edwards.

Show me the money

Johnstone says providing volume is the key role alternative finance players should look to fill in the UK market. "The biggest problem in leverage at the moment is there are very few people in the market. There's simply not the volume of debt needed to fund the dealflow. Having said that we have not failed to get debt for a deal yet."

In the US market, where alternative financing has been a major part of the private equity landscape for more than a decade, the large pool of non-bank debt providers means the market has considerable breadth, Johnstone says. "There's a lot of competition in the US market, but it hasn't had the effect of reducing pricing, and debt is actually slightly more expensive than over there. What this has done though is increase the availability of debt and gives much greater certainty of execution in the US," he explains.

Edwards agrees and says US alternative debt providers coming to the UK will be a major driver for change in the leveraged buyout market. "The US is where the talent lies to really make big strides in this market. Many major US players were coming in before the crisis. They pulled back but we're starting to see them return again."

Wells Fargo is one such firm. The US-based financial services firm recently acquired UK-based Burdale from Bank of Ireland, and made it part of Wells Fargo Capital Finance, which provides asset-based lending and specialised senior financing. Wells Fargo says the move will help it broaden its international presence.

Who you know

Relationships have often been a key part of the UK market, and over the years many established GPs have developed strong links with leveraged finance teams at the big banks. The importance of these ties is such that Capital Dynamics' Katharina Lichtner recently told unquote" that the fund routinely rings banks to assess their opinion of various GPs. "Established GPs have a strong relationship with the banks they use, but not every investor will be treated the same. It depends how you have treated the banks in the past," says Johnstone.

Edwards says strong relationships do not necessarily aid getting deals done. "Relationships can be a barrier to GPs seeking out an alternative to their usual bank lender," he says. "However, often the relationship is with the corporate manager rather than the institution itself, and if the parent bank won't lend for a particular deal, then the corporate manager's hands are tied."

"There just isn't the capability in the banking system to meet the needs of a lot of sponsors. The simple model of providing leverage based on a multiple of EBITDA is out-dated," Edwards adds.

Bank caution is set to increase in the coming years, as new regulations constrain balance sheets and lead large institutions struggling to deal with the consequences of their past mistakes. While some had speculated Basel III would result in a mass sell-off of bad debts, thought to amount to some €1.5trn across European banks according to KPMG, many banks are actually holding onto these debts, further hampering their ability to lend for new loans in the future. Furthermore, the ongoing Libor scandal could see a number of high-profile casualties among senior management at major UK banks, while incoming replacements are expected to adopt a more conservative approach.

Edwards says past business can be very damaging for the major banks, with past mistakes coming back to haunt them. "One major advantage that Investec has is we've got no legacy book full of bad loans. All the companies in our portfolio are growing and developing well," he adds.

Additionally, issues such as the Libor scandal are causing considerable reputational damage to the major lending institutions, and recent portfolio sell offs are also potentially damaging for GP-bank relations. Recently, Lloyds sold around £500m worth of loans, covering property, corporate loans and specialist finance. Though the sale primarily consisted of HBOS assets, some 26 loans to private equity backed companies by Lloyds were also included in the deal. The Lloyds asset sale has been described as "disappointing" by GPs, many of which prefer certainty of who will hold onto their portfolio company debt over the lifetime of an investment.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds