Fundraising

Video: Ely Place's Roddick on the latest LP/GP trends

Roddick discusses pre-fundraising campaigns, the denominator effect, allocation lessons learned from the GFC, and more

Spanish GPs navigate tough fundraising, deal-making environment

Unquote rounds up notable funds delayed or postponed, and gathers dealflow updates from managers

UK small-cap GPs look to build on growth amid Covid-19 turmoil

How pricing in the smaller PE segment will be affected by the coronavirus crisis is not yet clear

Coronavirus: European LPs contemplate course corrections

LPs are not unanimous in their opinion of how the current pandemic will reshape ways of thinking

Italian fundraising processes disrupted by Covid-19 crisis

A round-up of the processes affected, as well as those still pushing through despite the pandemic

Q&A: Cambridge Associates' Featherby on PE's time to shine

Very few managers will have net benefited from this crisis, says Featherby, but PE could still showcase its ability to outperform

Unquote Private Equity Podcast: Covid-19 special

The team gathers for its first remote podcast, discussing how the early stages of the outbreak have disrupted the European PE landscape

Debut managers to face daunting fundraising market in 2020

Debut managers out to market are unlikely to hold closes in 2020, and very few new teams are likely to launch funds

Several funds seeking to close in H1 face delays, says Cebile

LPs' reluctance to commit is likely to lead to a number of delays come Q2

Annual Buyout Review: European momentum likely to be hit hard

Unquote's lastest Annual Buyout Review is now available to download, offering in-depth statistical analysis of European buyout activity in 2019

Coronavirus outbreak leaves Italian PE industry in limbo

With Italy being the worst-affected European country, deals and fundraising are so far confined to a timeless limbo

Coronavirus outbreak could lead to fundraising logjam, PE players warn

Industry participants contacted by Unquote expect negative ramifications for fundraising as well as deal-making activity

2020 Outlook: Southern Europe finishes 2010s on record high

Deal volume was the highest on record in 2019 with 174 buyouts, though aggregate value decreased to €25bn from €30bn

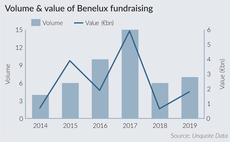

2020 Outlook: Benelux dealflow breaks records as fundraising recovers

While often out of the European private equity limelight on the deal-making side, the Benelux region quietly posted an excellent 2019

Unquote Private Equity Podcast: DACH fundraising special

The Unquote Private Equity Podcast hosts Paul Tilt and Harriet Matthews to discuss the findings of the latest DACH Fundraising Report

DACH Fundraising Report 2020

DACH private equity fundraising was in rude health in 2019, with 26 funds securing a combined €13bn across all strategies for the region

2020 Outlook: DACH buyout volume stalls amid macro uncertainty

Overall dealflow plateaued, with just one buyout more recorded in 2019 compared with 2018

2020 Outlook: Tech deals boom while fundraising flourishes in France

Local GPs look forward to another busy year and hope to build on the record dealflow seen in 2019

Unquote Private Equity Podcast: IPEM Highlights

The Unquote Private Equity Podcast recaps key takeaways from exclusive interviews with a number of speakers and delegates

2020 Outlook: Political change heralds UK buyout revival

Deal volume was down last year, but record-high value and a more settled political backdrop mean 2020 could be busy for the UK

IPEM TV 2020: Advent's Johanna Barr on navigating fund pitches

Managing director and global co-head of limited partner services shares key takeaways from her panel

Fund focus: Lexington targets growing Asia secondaries market

GP's ninth fund closed on $14bn, above its $12bn target, and will target secondaries opportunities in Asia

Unquote Private Equity Podcast: the Review/Preview special

In this special bumper episode, the Unquote editorial team does a deep dive on key 2019 stats in each market

Three UK charities on hunt for impact-focused managers

Successful manager would oversee a £32m portfolio with a focus on ESG and impact