Fundraising

France Fundraising Pipeline - Q4 2020

Unquote rounds up the most notable fundraises currently ongoing in the French market across the buyout, venture and secondaries spaces

European Circular Bioeconomy Fund holds first close

European Commssion-backed fund is targeting тЌ250m and aims to hold a final close by August 2021

Italian PE players highlight silver linings amid crisis

Fundraising challenges, portfolio support and new opportunities were key themes discussed at last week’s Unquote Italian Private Equity Forum

Unquote Private Equity Podcast: Allocate 2020 special

The Pod discusses our upcoming LP/GP conference, Allocate, touching on illiquidity solutions, secondaries, and ESG

Evolution Equity on the road for second fund – report

New York-headquartered venture capital firm held a final close for its debut fund in 2017 on $125m

GP Profile: ArchiMed

Following the close of its new €1bn fund, ArchiMed's Denis Ribon discusses the firm's fundraising experience and investment pipeline

Unquote Private Equity Podcast: H2 Preview

The Unquote Podcast gathers the whole team this week to go over H1 statistics, look at early recovery signs and share insights from across Europe

DACH holds up under pandemic pressure, but recovery doubts remain

Market players suggest it is unlikely that H1 figures reflect the extent of the damage done to portfolios and M&A

Southern Europe bounces back amid pandemic uncertainty

Southern European market has regained vigour and confidence in July following a catastrophic H1

EQ Asset Management eager to deploy following double fund close

EQ says it has completed five acquisitions through its secondaries fund since the outbreak of Covid-19

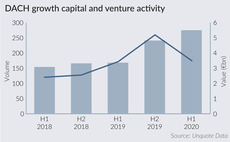

DACH venture and growth deals reach volume high in H1 2020

Growth and VC deal volume exceeded that of all previous half-yearly figures, although average deal size and fundraising activity declined

Unquote Private Equity Podcast: Made in Germany

This week, the Unquote Podcast focuses on Germany, where private equity activity has remained resilient despite Covid-19

How the crisis could affect fund T&Cs

In a tough funrdriasing and deal market, GPs will be looking for all the incentives they can possibly provide

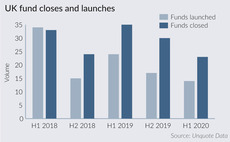

UK fundraising update: pausing for breath

A number of GPs that closed more than three years ago have delayed fresh fundraises, or have altogether decided to explore new options

Market sentiment improving but dealflow likely to remain bifurcated – Baird

Baird MDs Vinay Ghai and Paul Bail discuss deal-making amid the pandemic and emerging trends for the months ahead

Unquote Private Equity Podcast: Fundraising engine stalls

This week, the Unquote Podcast examines the fundraising market amid the challenges of Covid-19

LP Profile: CPP Investments

Unquote picks out key takeaways from CPPI’s latest annual report, and hears from head of PE funds Delaney Brown about the Canadian LP's strategy

DACH fundraising update: H2 2020 pipeline

Although the coronavirus pandemic has set back plans for many GPs, a number of buyout and venture vehicles are on the road in the DACH region

Reputational risk, early secondaries help assuage LP default fears

GPs that recently raised are the ones potentially more at risk, but market sources agree widespread defaults would be far-fetched

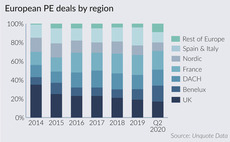

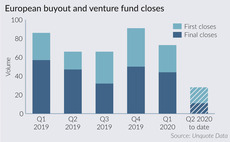

European fund closes slump by 42% amid lockdown

Unquote recorded 44 first or final closes of European PE funds between March and May, a 42% drop on the three-month average seen across 2019

DACH PE looks to mid-term effects as lockdowns ease

Local players do not anticipate a sudden return to action just because lockdowns are eased

Impact investing webinar: Capital Meets Conscience

Watch a virtual event on impact investing, with panellists including Bridges' Maggie Loo and Daniela Barone-Soares from Snowball

Video: OTPP's Topley discusses liquidity squeeze, GP discipline

Joe Topley, head of European funds at Ontario Teachers' Pension Plan, shares his LP perspective on the current state of the private equity market

GP Profile: Riverside Europe

Karsten Langer discusses how the firm's portfolio is coping with the coronavirus crisis, as the GP raises its sixth-generation fund