LPs

Partners Group to sell non-private-equity businesses

Partners Group has announced the sale of its remaining stakes in two non-private-equity-affiliated firms.

Adveq opens London office

Funds-of-funds manager Adveq has officially opened its new London office.

Texas retirement fund commits €40m to Nordic Capital VIII

The Texas County & District Retirement System (TCDRS) has committed тЌ40m to Nordic Capital's latest vehicle.

SVG enjoys 23% NAV boost in H1

SVG Capital has reported a 23% uplift in net asset value (NAV) in its half-year results, with shares now trading at 480p.

Grosvenor Capital acquires Credit Suisse's PE FoF division

US-based fund of hedge funds Grosvenor Capital Management (GCM) has acquired the fund-of-private-equity-funds division of Credit Suisse, Customised Fund Investment Group (CFIG).

Funds-of-funds falling out of favour?

Funds-of-funds

LGT Capital Partners wins £100m mandate

Swiss alternative asset management company LGT Capital Partners has been awarded a £100m mandate from Kingfisher Pension Scheme.

Family Office Survey 2013

Keep up to date with the latest trends in the Family Office Investment In Private Equity survey, published in association with Investec.

Carlyle to gain full control of AlpInvest

Carlyle has agreed to buy the remaining 40% stake in fund-of-funds manager AlpInvest, gaining full ownership of the business.

LP chief heads for private equity

Barry Miller, head of private equity at New York City Retirement System, has left to join secondaries specialist Landmark Partners.

AP6's Swartling on strategy, regulation and CSR

Karl Swartling, CEO of AP6, discusses the Swedish government’s Langensjö inquiry into state pension funds and its recommendations for drastic saving measures. How will it affect AP6 and how best to prepare for the changes?

Delta Lloyd drops out of private equity

Delta Lloyd has disposed of the private equity management arm of its investment division, Cyrte Investments BV, and will reportedly no longer deal in the private equity sector in the wake of the Solvency II directive.

France: commitments from banks, insurers, pension funds down 43%

France's lacklustre fundraising figures for 2012 highlight the continued retreat of traditional LPs, such as banks, insurers and pension funds, according to new research by industry trade body Afic.

Family offices keen on bypassing GPs?

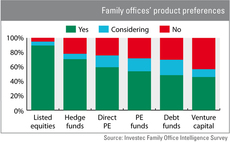

Nearly 60% of family offices polled in the Investec Family Office Intelligence Survey are considering investing in private equity. The headline figure is not the whole story, though.

CEE private equity: undervalued?

CEE: undervalued?

Family offices set to increase PE allocations

Family offices

In defence of private equity

There is increasing noise about unjustifiable fees in an industry that fails to live up to expectations. But this belies some outstanding performances and the promise of new opportunities, finds Kimberly Romaine

LP interview: Secondaries come first

LP interview: Idinvest

SVG Capital injects €100m into Cinven

Listed investment trust SVG Capital has committed тЌ100m to the latest fund managed by London-based GP Cinven.

Aberdeen acquires majority stake in SVG Advisers

Aberdeen Asset Management has acquired a 50.1% stake in SVG Capital subsidiary SVG Advisers (SVGA) for ТЃ17.5m.

Hertfordshire County Council commits £280m to LGT

LGT Capital Partners has received a £280m mandate for its multi-alternatives offering from the British Hertfordshire County Council.

Pension funds failing to stick up for private equity

Speaking up for PE

LP highlights misalignment of interest with GPs

LP slams GP fees

German funds: The LPs' verdict

LP verdict