Industry

AIFMD passed into German federal law

Germany has passed legislation for the implementation of the Europe-wide AIFM Directive into federal law, following a year of intense campaigning by representatives of the private equity industry.

Mezzanine makes its comeback

Mezz bounces back

Blackstone agrees to buy Strategic Partners from Credit Suisse

Blackstone Group has agreed to acquire Credit Suisse Group AG’s secondary private equity business, Strategic Partners, for an undisclosed price.

Nordic Capital: Clear strategy vital for success

Q&A: Nordic Capital

EU Commission contemplating stricter merger control laws

The EU Commission is thinking of introducing stricter controls on company mergers, threatening to lengthen processes for minority stake acquisitions.

Afic: France needs urgent PR boost

French PE

Equistone's de Blignières to raise €300m vehicle

Equistone senior partner Gonzague de Blignières is looking to raise €300m for Raise Capital, a new evergreen structure designed to provide growth capital to French SMEs.

BGF - two years on

BGF - two years on

EQT to merge European and Asian teams for new fund

EQT is merging its European mid-market business line with its Asian investment team, ahead of a rumoured new fund launch.

Advent, Bain in £340m WorldPay dividend recap

WorldPay, a card payment services provider acquired by Advent International and Bain Capital in 2010, has secured a ТЃ700m refinancing including a dividend recap for the private equity owners, according to reports.

Banks arrange debt for sale of 3i and Allianz's Scandlines

A debt package of up to €1bn is being put together for the sale of German ferry operator Scandlines, owned by 3i and Allianz Capital Partners, according to reports.

Nordic private equity market undergoes cautious evolution

The Nordic market is changing. Long dominated by the powerhouse economy of Sweden and seemingly impervious to the crisis gripping Europe, 2012 was a tougher year and saw many new developments.

France: commitments from banks, insurers, pension funds down 43%

France's lacklustre fundraising figures for 2012 highlight the continued retreat of traditional LPs, such as banks, insurers and pension funds, according to new research by industry trade body Afic.

BVCA chief Florman resigns

BVCA chief Mark Florman has resigned after just over two years in the post.

Finnish state launches €1bn start-up fund

The Finnish Economy Ministry is launching a тЌ1bn venture capital start-up fund to attract private investors.

UAE eases rules on private equity fund marketing

United Arab Emirates (UAE) rules have relaxed, making it easier to market private equity funds to investors there.

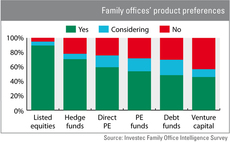

Family offices keen on bypassing GPs?

Nearly 60% of family offices polled in the Investec Family Office Intelligence Survey are considering investing in private equity. The headline figure is not the whole story, though.

Disgraced Crosby steps down from Bridgepoint role

Sir James Crosby has stepped down from his role on Bridgepointтs European Advisory Board following a report into his role in the collapse of UK bank HBOS.

Qualium to re-inject €30m into Quick as part of amend-and-extend

French investor Qualium is set to invest a further €30m of equity in restaurants chain Quick while the company's lenders have agreed to extend the terms of its debt, which was due to mature in 2015.

Record dry powder to expire in 2013, says Triago

Despite an expected increase in capital calls this year as GPs put more money to work, nearly $15bn worth of LBO commitments could be left unused and returned to investors in 2013, according to placement agent Triago.

CVC in court over $800m beer tab

CVC Capital Partners’ sole deal in Central & Eastern Europe – the local breweries of Anheuser-Busch InBev, StarBev – may leave the GP with a nasty hangover after court filings revealed AB InBev is seeking earn-out money following CVC’s subsequent sale...

CEE private equity: undervalued?

CEE: undervalued?

DLA Piper survey highlights rise of unitranche

Unitranche financing is predicted to be the most popular form of debt funding after senior-only provision in 2013, according to a new DLA Piper survey.

Family offices set to increase PE allocations

Family offices