Benelux

GP Profile: Ardian Expansion doubles down on generalist approach, eyes EUR 3bn Q2 fundraise launch

With its current EUR 1.5bn fifth fund almost at full deployment, Ardianтs Expansion strategy expects to benefit from LP appetite for its strategy ahead of EUR 3bn fundraise

Triton raises EUR 1.63bn for multi-asset continuation fund

Backed by HarbourVest and LGT, TIV CF will hold four Fund VI assets Assemblin, EQOS, Flokk and Unica

Carbon Equity open to commitments for new impact fund with EUR 125m hard-cap

Netherlands-based fund-of-funds manager will broaden its strategy to incorporate co-investments for its second fund

CVC Credit targets EUR 7bn for new European direct lending fund

Fresh fundraise follows the EUR 6.3bn final close for the strategy's predecessor vehicle in December 2022

Women in VC: MMV's Brunet on tech opportunities and navigating volatile markets

Alix Brunet speaks to Unquote about the VC firmтs deal pipeline and how it is engaging with portfolio companies and new founders

Gimv acquires majority stake in Witec

Belgium-based Gimv set to support Netherlands-headquartered contract design manufacturer’s growth

GP Profile: Opera Investment Partners doubles fund size with EUR 200m target for next vehicle

Fund I тalmost fully committedт with one exit completed and two-three more realisations expected in the next 18 months

Podcast: Q1 2023 - Bank runs, fund home runs and markets come undone

Unquoteтs reporting team discuss themes that have arisen in Q1 2023, ranging from liquidity management to venture and growth activity

4Impact heads for year-end close for EUR 125m second fund

Founded by ex-Goldman Sachs team, impact VC firm has made one investment from its latest fund so far

Forbion raises combined EUR 1.35bn for venture and growth funds

Ventures Fund VI closes on EUR 750m and Growth Opportunities II on EUR 600m with both upsized by over 60%

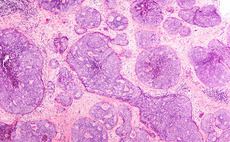

Gilde Healthcare hits EUR 600m target for Venture&Growth VI

Fund is 50% larger than predecessor thanks to “loyal” LP base; seeks late-stage deployment in medtech, digital health and therapeutics

Houlihan Lokey poaches Nielen Schuman's Theys to open up Antwerp office

Hire to cement Houlihan Lokey’s position in Belgium, which represents 30% of the advisor’s Benelux deals

The Bolt-Ons Digest – 17 April 2023

Unquoteтs selection of the latest add-ons with Triton's BFC Group, Seven2's Groupe Crystal, Palatine's FourNet and more

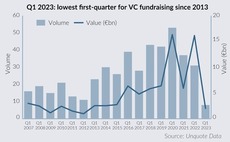

VC fundraising sinks further with lowest Q1 in a decade

Eight European firms secured just over EUR 2bn in commitments in Q1 2023 as continuing uncertainty suppresses LPsт risk appetite, but fundraising pipeline looks promising

Spending bottom dollar: Valuation gaps take Q1 buyout levels back to 2009

Sponsors make just 95 buyouts in Europe in the first quarter - a figure not seen since Sony sold 12m floppy discs in one year

PE roll-up strategies face regulatory heat with focus on consumer industries

With longer holding periods facilitating more bolt-ons, regulators including the UK's CMA are intervening

KKR holds USD 8bn European Fund VI buyout fund close with 12.5%-plus GP commitment

European Fund VI will deploy equity tickets of EUR 250m-750m in six core sectors

Mayfair kicks off third fund deployment with Jonckers buyout

Sponsor has seen a GBP 800m increase in AUM since its most recent exit in October 2022

VC Profile: Target Global assesses B2B opportunities in final stretch of current fund deployment

Nearing full deployment for its second growth fund, pan-European VC firm outlines plans to back defensive B2B models and institutionalise its co-investment strategy and LP base

Large-cap sponsors circle Qiagen bioinformatics arm ahead of indicative bids

Potential PE bidders are assessing performance and market share of the Netherlands-headquartered business

Bencis raises EUR 123m continuation fund for group of Fund IV assets

Secondary deal was led by Committed Advisors and will provide backing for future growth of four portfolio companies

EQT closes LSP Dementia on EUR 260m hard cap

Series A-focused fund exceeded its EUR 100m target and extended fundraising after increased LP interest in its strategy

Newton Biocapital heads for year-end close for second, EUR 150m life sciences fund

Belgian-Japanese VC has raised EUR 50m to date and is lining up exits from its debut fund

Armen eyes 2023 final close for debut fund after first close and stake sale

Sponsor sells 20% stake in itself to family offices as EUR 400m fundraise continues