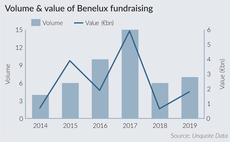

Benelux

PE still hungry for retirement homes, but infra funds loom

Eight deals were completed in the retirement homes sector across Europe in 2019, above the annual average of five since 2014

Main Capital Partners exits Onguard to trade

GP stands to make a double-digit money multiple from the sale of the credit software company to Visma

VC Profile: CapitalT

Co-founder Janneke Niessen talks to Unquote about the firm's fundraise and its data-driven model to analyse startup teams

CapitalT holds first close for debut fund

VC firm was founded by Janneke Niessen and Eva de Mol, and will target €40m for its first vehicle

KKR-backed Gamma takes stake in Univercells subsidiary

KKR's $50m investment in Univercells will be drawn from its Health Care Strategic Growth Fund

2020 Outlook: Benelux dealflow breaks records as fundraising recovers

While often out of the European private equity limelight on the deal-making side, the Benelux region quietly posted an excellent 2019

Vesalius, Swisscanto in €19m series-B for OncoDNA

Fresh capital will be used for international growth and software development acceleration

Main Capital sells TPSC to PE-backed Symplr

Sale ends a six-year holding period for the GP, which bought TPSC via its €40m Main Capital III fund

Parcom Capital acquires Euramax Coated Products

US-based parent company Omnimax International sold the business to the Netherlands-based GP

Shoe Investments, Knight Venture in €2.75m series-A for Dealroom

Funding will support Dealroom's continued international expansion in Europe and beyond

Q4 Barometer: Continued buyout bonanza tops record-breaking year

Private equity investors completed 807 deals in Q4 2019, tipping the year into record-breaking territory

KKR closes Global Impact Fund on $1.3bn

Fund targets lower-mid-market companies in the Americas, Europe and Asia, which contribute to sustainable development

Cerberus sells Covis Pharma to Apollo

Sale ends a nine-year holding period for the GP, which built Covis through a series of acquisitions

Direct lenders eye secondaries market for first-gen funds

Several European direct lenders are speaking to secondaries advisers about running processes on older vintage funds

Stirling Square closes fourth fund on €950m

Fund targets buyouts in European mid-market companies with enterprise values of тЌ50-500m

VCs in €20m series-B for PDCLine

In 2016, Belgian VC Meusinvest, Spinventure and several business angels invested €4m in the company

PAI Partners to launch €600m mid-market fund

Vehicle will target companies based across Italy, Spain, Germany, France and the Benelux region

Unquote Private Equity Podcast: the Review/Preview special

In this special bumper episode, the Unquote editorial team does a deep dive on key 2019 stats in each market

Ergon Capital Partners to back CompaNanny

Belgian GP plans to back the company, according to a document by the Dutch competition authority

OxGreenfield backs Bavak Beveiligingsgroep

Founded in 2019, OxGreenfield backs Dutch companies generating a turnover of up to €50m

EQT sets €14.75bn target for new flagship fund

EQT registered several vehicles in Luxembourg in November last year ahead of the launch

Vortex buys Assai Software Services

GP draws equity from Vortex Buyouts II, which closed on €35m in 2017 and is now more than 50% deployed

3i creates new bioprocessing platform with Cellon acquisition

GP is currently looking for a CEO to sit across the divisions of the new platfom

Vendis appoints Riisberg as senior adviser in Nordic region

Christian Riisberg was previously founding partner of Alipes and a board member for various companies