DACH

RTP Global holds final close for fourth fund on USD 1bn

Fundraise is New York-headquartered early-stage venture capital firmтs largest to date

Unquote Private Equity Podcast: PE perspectives from Berlin

Unquoteтs Min Ho and Rachel Lewis digest the key takeaways from this yearтs SupeReturn

EU Foreign Subsidies rules hold specific challenges for PE

Sovereign wealth funds and pension funds commitments may trigger EC attention under new EU foreign subsidies regulation

Strada Partners heads for 2024 final close for EUR 150m debut fund

Emerging Belgian manager was formed last year and will ink deals with EUR 5m-EUR 50m equity tickets

GP Profile: Bregal Milestone explores generative AI opportunities for portfolio companies

Plans seven further deals from recently closed EUR 770m fund

IK-backed Klingel advances to round two with Altor among sponsors circling

Novo Holdings and AEA Investors also tipped to be in the final stretch for the German medical equipment company

MPEP launches fifth buyout fund-of-funds with EUR 300m target

Lower mid-market specialist will continue to apply thorough due diligence for new and existing relationships, seeking persistency of returns

Nordic Alpha Partners secures EUR 150m for second greentech fund

Hardtech sustainability-focused GP expects to continue its fundraise throughout 2023 following its first close and firm's first strategic exit

European LPs bullish on 2024 PE fund vintages – Coller Capital

LPs remain positive on PE but are considering increasing infra and private credit allocations, latest survey shows

Main Capital exits Cleversoft to LLCP

Nordic Capital and OTPP's Mitratech were also in the running to buy the regtech platform, Mergermarket reported

BlackRock buys growth and venture debt provider Kreos

Global asset manager plans to broaden Global Credit business with fresh acquisition

From slash-and-burn to grow-and-earn: private equity changes tack

Rising cost of capital means value-creation will be vital for next decade of private equity, SuperReturn participants said

Investec acquires majority interest in corporate finance firm Capitalmind

Transaction will see the advisory firms fully integrating their M&A and corporate finance teams

Mobilab signs deal with Armira in crowded small-cap auction

Founder-owned data applications and infrastructure provider drew sponsor and strategic interest

Archimed closes MED II on EUR 3.5bn

Healthcare-focused GP took 17 months to raise its second mid-cap fund, which has already deployed almost EUR 1bn

EQT mandates Bank of America for Schuelke sale

GP bought the Germany-based infection prevention firm from France’s Air Liquide in 2020 via EQT VIII

Adams Street secures USD 3.2bn for newest secondaries programme amid LP stakes dealflow uptick

Private markets investor has seen LP stakes increase as a proportion of its deployment over the past year, partner Jeff Akers said

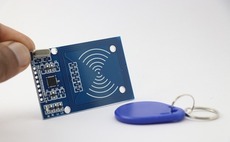

SGT Capital to acquire Summit-backed Elatec for EUR 400m

Mid-market sponsor looks to grow company via “continued technical innovation” and international expansion

Golding aims to raise EUR 350m for next buyout co-investment fund amid 'unprecedented' dealflow

Vehicle expects to make its first deals this year, providing additional equity for deals against a tough fundraising backdrop

Mimir Group ramps up global origination effort with London office and focus on life science carve-outs

Stockholm-based investor is considering divestments, although challenging market remains a barrier

Gyrus Capital acquires LRE Medical from KPS-backed AIS Global

Carve-out of German diagnostic equipment manufacturer comes over two years after first sale attempt

The Bolt-Ons Digest - 26 May 2023

Unquoteтs selection of the latest add-ons with H&F's TeamSystem, Nordic Capital's Regnology, 3'i's Dutch Bakery and more

Verdane bolsters German presence with partner hire and new Munich office

Former EMH partner Dominik Schwarz joins growth investor’s second German office

Moonfire Ventures raises USD 115m to back early-stage startups in Europe

AI-powered VC firm has raised USD 90m for Fund II and USD 25m for its Opportunity Fund to double down on winners