DACH

Unquote Private Equity Podcast: The PE auction in times of exit scarcity

Rachel Lewis joins Harriet Matthews to discuss how auction process dynamics are changing against the current market backdrop

DBAG turns focus to proprietary dealflow as auctions slowdown

Valuations could cool off as debt availability tightens, German GP's partner Thilo-Anyas Koenig tells Unquote

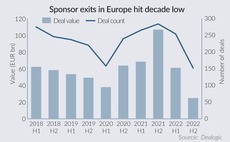

Going, going, not gone: PE auctions bid for relevance amid risk-off environment

With a debt financing drought and macro woes denting exits, GPs are adapting the traditional M&A auction in favour of more flexible bilateral negotiations to get deals across the line

Bellevue eyes Q1 2023 first close for debut secondaries fund

With USD 200m target, vehicle will primarily focus on USD 1m-30m LP stake deals

Partners Group sets fundraising guidance at USD 17bn-22bn

Private markets investor finished 2022 at the bottom of USD 22bn-26bn target for new commitments

Dyal raises USD 12.9bn for new fund with CVC, PAI stakes in portfolio

Blue Owlтs division exceeded target for fifth fund specialised in buying minority stakes in asset managers

EQT weighs options for Open Systems including partial sale

Bank of America to prepare sale of the group's secure access service edge network division

DBAG sells Pmflex following trade approach

Pre-wired electrical installation conduits manufacture sold to Hager Group following a 2.5 year investment period

Tenzing launches Munich office; hires KPMG exec as DACH head

Christian Ramme to lead local team as UK-based GP takes another step in European expansion

Inflexion acquires minority stake in Proteros

Deal for German contract research organisation is the sponsor's third in pharma services in past 12 months

Hamilton Lane raises USD 2.1bn for fifth co-investment fund

Close comes at a time when challenging credit and fundraising markets are increasing GPsт need for strategic capital sources

DBAG wraps up Fund V with Heytex exit

German sponsor sells textile manufacturer to Bencis Capital; 2006 vehicle returns over 2.5x to LPs after 11 exits

AG Capital kicks off inaugural fund with Improove buyout

Austrian emerging manager acquires local SEO agency with country's first buyout fund in a decade

General Atlantic holds USD 2.6bn final close for debut climate fund

BeyondNetZero strategy has USD 3.5bn to deploy in total with additional firepower from the GP

Permira announces changes in DACH leadership

Jörg Rockenhäuser to become region’s first chairman as Florian Kreuzer succeeds him as head of DACH

IK to exit Quanos in sale to Keensight Capital

New owner plans to grow Germany-based software developer organically and through M&A

PAI Partners to acquire IFF's Savory Solutions in USD 900m deal

GP is investing in the artificial aromas and flavours manufacturer via latest flagship fund

Bellevue hires ex-Partners Group trio for new secondaries strategy

Switzerland-based asset manager plans to launch first secondaries vehicle in 2023

Afinum, Invision-backed Ledlenser prepped for sale

LED flashlight and headlamp producer has been owned by sponsors and management since 2018

Unquote Private Equity Podcast: 2023 - New year, new market?

Unquote and Mergermarketтs private equity reporting team discuss the past 12 months and what lies ahead next year

Equistone makes three ESG manager hires

London, Paris and Munich appointments will assist with ESG in the investment and portfolio management processes

Private Equity Trendspotter: Sponsors look for sure footing as market slowdown signals change in deals landscape

Aggregate buyout volume brings 2022 just 6% above pre-pandemic dealmaking, with a significant sentiment shift in H2 2022

Munich Private Equity closes Fund IV on EUR 392m

Fund-of-funds investor will split deployment evenly between Europe and North America

Clearwater Multiples Heatmap: Valuations ease as PE deals slow down

After a record quarter, Q3 2022 sees sponsor transactions fall sharply amid challenging macro environment