France

52 Entertainment sale enters final round in sponsor-heavy auction

PE owner HLD invested in the Paris-based gaming platform in 2018; it has since made nine add-ons

European VCs need to match actions to words by increasing funding to female-led companies

Women-led startups usually receive less than 2% of VC capital, but more diverse, defensible female-founded businesses emerging

Eurazeo halves deployment and PE fundraising in Q1 amid 'complex and uncertain' environment

GP has EUR 7.7bn dry powder across its strategies and remains assured of its potential to make exits in H2 2023

Unquote Private Equity Podcast: Taking the plunge - GPs dive into alternative pools of capital

The Unquote team is joined by Thomas EskebУІk, CEO of private markets platform Titanbay, to discuss private marketsт search for alternative sources of commitments

Cerea Partners raises EUR 700m-plus for multi-asset food and beverage funds

France-headquartered GP is on the road for vehicles across its private equity, mezzanine and senior debt strategies

PAI Partners to acquire The Looping Group from Mubadala Capital

GP will take a majority stake in French leisure park operator via its latest flagship vehicle, PAI Fund VIII

Heran Partners nears full deployment of debut fund, mulls next fundraise

Health tech-focused VC is seeking three further software and hardware deals from EUR 75m debut vehicle

GP Profile: Ardian Expansion doubles down on generalist approach, eyes EUR 3bn Q2 fundraise launch

With its current EUR 1.5bn fifth fund almost at full deployment, Ardianтs Expansion strategy expects to benefit from LP appetite for its strategy ahead of EUR 3bn fundraise

Carbon Equity open to commitments for new impact fund with EUR 125m hard-cap

Netherlands-based fund-of-funds manager will broaden its strategy to incorporate co-investments for its second fund

VC Profile: Klima lines up green energy deals from EUR 210m debut fund

Franco-Spanish Alantra and EnagУЁs-backed VC initiative expects to lay the foundations for its second fund in 2024

CVC Credit targets EUR 7bn for new European direct lending fund

Fresh fundraise follows the EUR 6.3bn final close for the strategy's predecessor vehicle in December 2022

Women in VC: MMV's Brunet on tech opportunities and navigating volatile markets

Alix Brunet speaks to Unquote about the VC firmтs deal pipeline and how it is engaging with portfolio companies and new founders

Kartesia's management to take majority stake in Flexam

Pan-European capital solutions provider’s partnership with France-based fund manager will add real-asset financing to its offering

Podcast: Q1 2023 - Bank runs, fund home runs and markets come undone

Unquoteтs reporting team discuss themes that have arisen in Q1 2023, ranging from liquidity management to venture and growth activity

The Bolt-Ons Digest – 17 April 2023

Unquoteтs selection of the latest add-ons with Triton's BFC Group, Seven2's Groupe Crystal, Palatine's FourNet and more

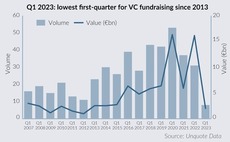

VC fundraising sinks further with lowest Q1 in a decade

Eight European firms secured just over EUR 2bn in commitments in Q1 2023 as continuing uncertainty suppresses LPsт risk appetite, but fundraising pipeline looks promising

Charterhouse transfers Sagemcom to AlpInvest-backed continuation fund - filings

GP will make a return of over 5x MOIC on the deal for French telecoms business

Spending bottom dollar: Valuation gaps take Q1 buyout levels back to 2009

Sponsors make just 95 buyouts in Europe in the first quarter - a figure not seen since Sony sold 12m floppy discs in one year

PE roll-up strategies face regulatory heat with focus on consumer industries

With longer holding periods facilitating more bolt-ons, regulators including the UK's CMA are intervening

VC Profile: Hi Inov in pre-marketing for next fund, outlines plans to wrap up Fund II investment period

France and Germany-based early-stage investor has made 15 of its up to 20 planned investments from its EUR 100m Fund II

GP Profile: Metric Capital confident of structured capital strategy demand with multiple exits in pipeline

UK-based sponsor banks on appeal of its strategy as an alternative to private equity and debt providers

KKR holds USD 8bn European Fund VI buyout fund close with 12.5%-plus GP commitment

European Fund VI will deploy equity tickets of EUR 250m-750m in six core sectors

Infravia aims to raise up to EUR 1bn for next growth fund, eyes mid-2024 launch

French sponsor expects to raise EUR 750m-EUR 1bn for B2B tech-focused second growth fund

EQT closes LSP Dementia on EUR 260m hard cap

Series A-focused fund exceeded its EUR 100m target and extended fundraising after increased LP interest in its strategy