Nordics

Carbon Equity open to commitments for new impact fund with EUR 125m hard-cap

Netherlands-based fund-of-funds manager will broaden its strategy to incorporate co-investments for its second fund

CapMan bolsters Wealth Services team, plans to scale up offering in Sweden

Finnish GP has hired Mika Koskinen from corporate bank SEB as managing partner for Wealth Services unit

CVC Credit targets EUR 7bn for new European direct lending fund

Fresh fundraise follows the EUR 6.3bn final close for the strategy's predecessor vehicle in December 2022

Women in VC: MMV's Brunet on tech opportunities and navigating volatile markets

Alix Brunet speaks to Unquote about the VC firmтs deal pipeline and how it is engaging with portfolio companies and new founders

GP Profile: Opera Investment Partners doubles fund size with EUR 200m target for next vehicle

Fund I тalmost fully committedт with one exit completed and two-three more realisations expected in the next 18 months

Assessio sponsor Main Capital preps sale via William Blair

Software sponsor acquired the Swedish recruitment platform in 2019 for EUR 20m

Podcast: Q1 2023 - Bank runs, fund home runs and markets come undone

Unquoteтs reporting team discuss themes that have arisen in Q1 2023, ranging from liquidity management to venture and growth activity

Bregal Milestone prepares Epassi exit via JP Morgan

Bregal Milestone has held a majority stake in the Finnish employee benefit platform since 2019

GP Profile: Aurelius goes global with US expansion as it eyes new EUR 800m fund

German carve-out specialist is 18-24 months away from fundraising for its Fund V with EUR 750-EUR 800m target

Polaris acquires majority stake in Sealing System

GP currently deploying capital in its 2021-vintage Polaris Private Equity V with EUR 690m in commitments

Metric Capital and Scope acquire majority stake in Maileg

Deal for Danish toy brand marks second investment this year out of Metricтs fourth fund, which is now about 85% deployed

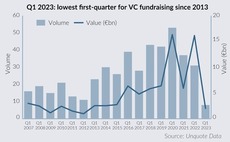

VC fundraising sinks further with lowest Q1 in a decade

Eight European firms secured just over EUR 2bn in commitments in Q1 2023 as continuing uncertainty suppresses LPsт risk appetite, but fundraising pipeline looks promising

Wellspect bidders CVC, KKR, PAI, EQT expected to progress into second round

US trade owner attempted a previous sale for the Swedish bladder and bowel-control products specialist in 2018

Procuritas raises EUR 407m for PCI VII

Swedish GP's seventh fund is 28% larger than predecessor and will invest in Nordic buyouts

Spending bottom dollar: Valuation gaps take Q1 buyout levels back to 2009

Sponsors make just 95 buyouts in Europe in the first quarter - a figure not seen since Sony sold 12m floppy discs in one year

PE roll-up strategies face regulatory heat with focus on consumer industries

With longer holding periods facilitating more bolt-ons, regulators including the UK's CMA are intervening

KKR holds USD 8bn European Fund VI buyout fund close with 12.5%-plus GP commitment

European Fund VI will deploy equity tickets of EUR 250m-750m in six core sectors

Riverside acquires Dastex and Vita Verita

Sponsor plans to pursue a buy-and-build strategy for new European clean room contamination control group

EQT closes LSP Dementia on EUR 260m hard cap

Series A-focused fund exceeded its EUR 100m target and extended fundraising after increased LP interest in its strategy

Armen eyes 2023 final close for debut fund after first close and stake sale

Sponsor sells 20% stake in itself to family offices as EUR 400m fundraise continues

Half of LPs allocating to impact from generalist pool as market matures – Rede Partners

Jeremy Smith and Kristina Widegren speak to Unquote about key takeaways from the private capital adviserтs Private Markets Sustainability and Impact Report

Caverion minority shareholders cautious on rival bid upside as Bain mulls options

Listed Finnish construction company has received takeover offers from Triton and Bain Capital

European sponsors sidestep panic, concede gloom over bank woes

Fallout from Credit Suisse collapse adds to slew of macroeconomic challenges for PE dealmaking and fundraising

Deals face further financing uncertainty after Credit Suisse rescue

Delayed return of stabilized M&A conditions expected, advisors say; mid-cap transactions stand to fare best