Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Main Capital sells Dutch software firm Tedopres to Etteplan

Main Capital has exited Dutch software company Tedopres after a six year holding period, completing its second exit in 2012.

Private equity set to take centre stage in Italy

The current lack of bank lending for family-run SMEs spells good news for Italian private equity. But a growing focus on innovation might also give venture a much-needed boost. Amy King reports

Greenpark Capital opens office in Hong Kong

Greenpark Capital has opened a new office in Hong Kong, to be headed by Chin Chin Teoh.

Gimv leads €6m funding round in GreenWatt

Gimv, Innogy Venture Capital, SRIW and existing investors have committed €6m of capital to fund the expansion of Belgian alternative energy company GreenWatt.

Arcano closes secondaries fund on $700m

Madrid-based Arcano Capital has closed its third fund on $700m.

Private equity could profit from QE threat to sovereign bonds

According to the National Association of Pension Funds (NAPF), quantitative easing efforts depress ROI of pension funds committed to gilts, which could push them towards alternative assets.

Zurmont Madison acquires majority stake in AKAtech

Zurmont Madison Private Equity has acquired a 55% stake in Austrian electromechanical assembly and manufacture firm AKAtech Produktions.

Colony Capital completes PSG exit

Colony Capital has sold its remaining 30% stake in French football club Paris St Germain (PSG) to Qatar Sports Investments (QSI) in a deal that reportedly values the club at €100m.

Equinox to acquire stake in Italy's third largest bank

Equinox Investment is looking to buy a significant part of the 15% stake in Banca Monte dei Paschi di Siena being sold by its core shareholder, according to reports.

Alven et al. in $5m round for Commerce Guys

Alven Capital and Open Ocean Capital have joined existing investor ISAI in a $5m round of funding for French e-commerce solutions provider Commerce Guys.

General Atlantic and Axel Springer set up €1.25bn joint venture

General Atlantic has invested €237m for a 30% stake in Axel Springer Digital Classifieds GmbH, a joint venture with German publisher Axel Springer.

Gresham-backed TTG bolts on Red-M

Gresham Private Equity portfolio company Team Telecom Group (TTG) has acquired wireless technology company Red-M.

Key Capital appoints managing partner

Key Capital Partners (KCP) has appointed Owen Trotter, co-founder, as managing partner. His appointment is part of the firmтs strategic development plan.

Investec provides debt for 2M co-founder buyout

Investec has provided a debt facility for chairman and co-founder Mottie Kessler's buyout of 2M.

Matrix hits grand slam for deals, exits in 2011

As the downturn drags on, most GPs are laying low and hoarding cash. One small buyout house stood out for achieving four investments and four new exits in 2011 т and has just announced its independence. Kimberly Romaine reports

KKR near final exit from Legrand

KKR has sold a further 12.7 million shares in listed French electrical equipment group Legrand, according to reports.

BGF: "We are not scraping the bottom of the barrel"

Business Growth Fund (BGF) chief executive Stephen Welton today addressed concerns about the fundтs approach to financing small UK businesses. Greg Gille reports

LDC hires Gould as director

LDC has hired Ged Gould, finance director of previous portfolio company American Golf, as director in its North West team.

DC Advisory Partners appoints managing director

DC Advisory Partners has appointed Sergio Ronga as a third managing director to its debt advisory group.

AAC Capital UK sells Amtico to Mannington Mills

AAC Capital UK has sold Amtico Group, an international designer and manufacturer of high end flooring, to Mannington Mills, a US-based provider of branded flooring products.

Chamonix and Electra acquire Peverel from administrators

Chamonix Private Equity and Electra Partners have announced a ТЃ62m acquisition of property management services company Peverel Group from administrators Zolfo Cooper.

FF&P backs MBO of British company CreditCall

FF&P and Bestport Ventures have taken a majority stake in British payment technology business CreditCall.

OEP buys Linpac Allibert

One Equity Partners (OEP) has wholly acquired Linpac Allibert, the returnable transport packaging business of Linpac Group.

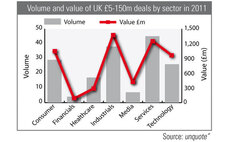

Business services keeps UK mid-market ticking

The UK's hugely important services sector remained key to the private equity market in the ТЃ5-150m segment. The 45 deals recorded in 2011 makes it easily the most important in volume terms, while its lower average deal size leaves it number two behind...