Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

B Capital closes second fund on $820m

Fund invests in series-B, -C and -D rounds to support B2B and B2C startups based across Asia, Europe and the US

Bridgepoint Development Capital to exit KGH Customs Services to trade

UK-based GP exits the business six years after acquiring it from Procuritas

Capiton-backed CymbiQ Group buys Aspectra

Deal is the third bolt-on for the IT service in its cybersecurity buy-and-build strategy

Antares launches €300m UTP fund for fashion sector

Fondo Lusso & Lifestyle is dedicated to bank credits, with a special focus on UTP exposures

TnuiCapital to acquire Busaba

Terry Harrison, Busaba Eathai's managing director, is to remain at the helm

Golding holds first close for private debt vehicle

Fund-of-funds has already completed one co-investment and has made a number of primary commitments

Spanish impact fund Fondo Bolsa Social targets €25m

Fund targets early-stage companies able to generate a positive and measurable social or environmental impact

Rileys hires FRP to assist with rescue plan

Rileys CEO Craig Mayes confirmed the appointment of FRP to examine options going forward

Cinven-backed Partner in Pet Food buys Doggy

Cinven acquired Budapest-headquartered pet food manufacturer Partner in Pet Food in April 2018

Intriva acquires Lending Works

Nicholas Harding, chief executive officer of Lending Works, will continue to lead the business

Searchlight-backed GRP acquires Premier Choice

Searchlight Capital bought a majority stake in GRP in February 2020 from Penta Capital

Andera closes Cabestan Croissance fund, inks first deal

Growth capital fund closed on €80m in Q1, after holding a €60m first close in December

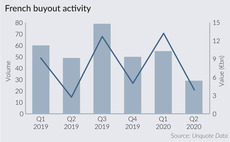

Lockdown impact derails French buyout momentum

Even as France is now moving on, the uncertain road ahead is threatening to undo months of improving activity and market sentiment

Triton's Eqos Energie bolts on AML Elektrotechnik

Austria-based electrical engineering company had filed for insolvency in April 2020

Aldea Ventures launches €150m fund-of-funds

VC house expects to hold a €35-45m first close by the end of July and a final close in around one year

17Capital provides £125m in preferred equity to Exponent III

LPs in Exponent III include Aberdeen Standard Investments, Central Pension Fund and CNP Assurances

NewAlpha acquires majority stake in CHR Numerique

Company has generated €12m in revenues and has a 25% EBITDA margin

Capiton sells Trioptics to trade

Exit to Jeniotik follows a five-year investment period and is the second exit from Capiton IV

Callista Private Equity buys two Mikron subsidiaries

Carve-out acquisition marks the Munich-based special situations investor's third deal of 2020

Axa Venture leads €5.2m round for Unlatch

Company plans to use the fresh capital to boost its international growth, primarily in Spain and the UK

Tar Heel buys 70% stake in Estetique

GP is looking to create a nationwide dental group and intends to sell it in five to seven years to an industry investor

Zeus makes six promotions

Zeus has promoted Nick Cowles to deputy head of corporate finance and Jordan Warburton to director

Seventure, BioGeneration lead €18.5m round for Citryll

Pharma company has so far raised €33.5m from private backers

Acton sells stake in Momox to Verdane

Verdane will own an 85% stake in the Germany-based e-commerce company via its 10th fund