Lockdown impact derails French buyout momentum

Even as France is now emerging from a stringent lockdown, the uncertain road ahead is threatening to undo months of improving activity and market sentiment. Mariia Bondarenko reports

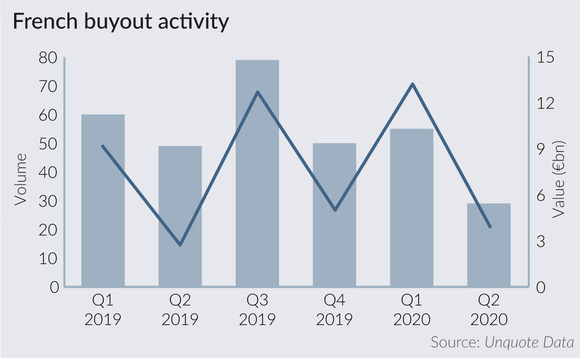

France enjoyed a more robust first quarter than a number of its neighbours this year, with both deal volume and value increasing on the previous quarter, according to Unquote Data. Deal volume increased 8%, regaining some momentum after a weak Q4. In terms of deal value, France had its strongest quarter in the last 10, recording €13.4bn in aggregate buyout value, up from €5bn in Q4.

This outperformance is unlikely to be repeated for some time, though. Monthly deal volume has been gradually decreasing since January 2020, with predictably depressed totals in March and April.

A sizeable number of deals that were not signed before the lockdown are now on hold – even the March figures will by and large reflect transactions inked pre-Covid-19. Of the 180 deals announced in Q1 2020, almost 24% (43) are still pending, according to the latest Deal Drivers report by Mergermarket. A significant proportion of these may yet convert from 'pending' status to 'lapsed' or 'withdrawn'.

The only exception are small transactions that do not require leverage to get over the line. "As long as there is a need to reach out to banks to get new, large financing for the transaction, it is much more challenging for the time being," says Fabrice de la Morandiere, a private equity partner at Linklaters. He adds that non-French banks have practically deserted the market, too, especially when it comes to US lenders.

In general, banks have been quite supportive throughout the Covid-19 outbreak, contributing to a number of state-guaranteed financing schemes. Oliver Golder, a partner at Siparex, says lenders will face challenges in assessing the normative profitability of companies, which means the available leverage is likely to be more limited. "However, it is too soon to say, as we have not seen many concrete situations post-crisis," he says.

The lack of debt financing is already being felt in the large-cap segment, as there was only one deal valued at more than €1bn in Q2, while Q1 saw three deals valued in the €1-5bn.

The largest deal of Q2 was Bridgepoint's acquisition of a majority stake in French insurance broker Groupe Financière CEP from US-based investment firm JC Flowers. The deal values CEP at around €1.3bn, equal to approximately 10x EBITDA. The second largest deal was the investment in ArchiMed portfolio company Polyplus-transfection, a gene and cell therapy specialist, made by US-based private equity firm Warburg Pincus. According to a source familiar with the situation, the deal valued the company at €550m. HLD Europe also recently announced it is in exclusive negotiations to acquire a majority stake in petrol station and fuelling equipment company TSG, in a deal understood to value the company at €550m.

Most deals announced between April and June were companies operating in software (38 deals), business support services (nine) and biotechnology (nine) – industries that are expected to be the most popular for PE in the short term, as they are generally seen as more crisis-resilient.

Tough times ahead

Not surprisingly, local GPs are negative in their forecast – deal volume is expected to come down further, as firms have been focused on monitoring, managing and assuring liquidity in their portfolio. "The current trading of various companies is not that good, as companies had been shut down for three months. We expect the number of deals to decrease by 30-40% in 2020, compared with 2019," says LBO France's Nicolas Manardo. Since the start of the lockdown, there has been very limited deal activity in Europe, but France has been among the countries most affected in terms of its usual market share, seeing fewer transactions than both the UK and Germany.

With the lockdown recently eased in France, many people are now back working in offices. However, this is yet to have a significant bearing on PE activity. "We work with corporates, and not everybody is back to normal among them," says Anthony Dubut, CEO at InnovaFonds. "There are a few new processes, but they are not imminent," he says, adding that dealflow is likely to become more significant in September or October.

The second half of the year could see fewer processes and transactions due to a more limited access to leverage. But, on the other hand, there might be more primary, and therefore less competitive, opportunities that will involve direct one-to-one conversations, according to local players. In addition, privately owned companies will be looking for build-up acquisitions and may open up their equity in order to finance them, says Siparex's Golder.

As businesses struggle to attract financing, valuations are likely to go down. "Companies will be running out of cash faster, resulting in a rise in the number of opportunities, as well as casualties," says Hervé Gevers, senior vice-president at Unigestion. "The difficulty will be to sift out the bad from the good. Investors betting on the right horses may benefit from lower valuations than pre-Covid-19." However, this is not expected to happen immediately, adds LBO France's Manardo: "From the various opportunities we have seen and from what we have heard from bankers, price expectations are still quite high. Prices may go down a bit but not right now, possibly by the end of the year".

Given the market uncertainty, activity is not expected to pick up significantly in the near future, despite the vast amounts of dry powder raised by French GPs in the past couple of years. All market players Unquote spoke to agree that it should approach normality by the end of the year, and more likely in 2021, once the effect of the crisis is fully assessed and the debt market is reopened again.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds