Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Travers Smith names new head of PE and financial sponsors group

Lucie Cawood's appointment follows poaching of Ian Shawyer by Cleary Gottlieb earlier this month

German health minister's 'locust sponsors' comments spook live healthcare deals

New entrants scared by remarks on limiting profits; existing investors expected to rush to complete bolt-ons

Ardian plans North American drive with tech, services deals on radar

French sponsor looks to more than double exposure to US and Canada when next flagship buyout fund launches

Koinos Capital explores return to fundraising trail in 12-18 months

Italian SME-focused GP could seek EUR 200m for new vehicle; Fund I set to reach 70% of deployment by year-end

Q4 Barometer: deal count remains steady amid tough environment

The latest Unquote Private Equity Barometer, produced in association with abrdn, is now available to download

InnovaFonds gears up for first close of new SME fund

French GP’s mezzanine and small equity tickets vehicle aims to attract institutional investors and has a EUR 100m target

Flight to quality, impact investing to drive allocations in 2023 – HarbourVest

Asset managerтs investment team discusses secondaries and co-investment dynamics amid a challenging fundraising market

Progressio exits Assist Digital in sale to Ardian

French GP plans further internationalization and M&A for Italian CRM technology provider

IK readies Swedish biotech group Mabtech for exit

Jefferies hired as sellside advisor; dual-track process for potential sale or IPO considered

Unquote Private Equity Podcast: The PE auction in times of exit scarcity

Rachel Lewis joins Harriet Matthews to discuss how auction process dynamics are changing against the current market backdrop

Presto Ventures targets EUR 100m for new early-stage fund

Czech VC seeks to attract larger institutional investors from Western Europe and US for its third vehicle

Arcano holds EUR 450m final close for latest secondaries fund

With just under 50% deployed, the vehicle will split focus evenly between LP stakes and GP-leds

Equistone to exit Bulgin to Infinite Electronics

UK sealed connectors manufacturer set to accelerate US expansion under trade owner

Waterland raises EUR 4bn for buyout and minority funds

Flagship fund closed EUR 1bn above predecessor amid a tough fundraising environment for midcap GPs

Merito Partners targets EUR 50m for debut growth equity fund

Sponsor plans to build a portfolio of 12-18 companies, with EUR 12m in fund commitments secured to date

Accel-KKR weighs strategic options for Kerridge Commercial Systems

ERP software provider could seek a sale or bring in additional PE investor; Arma advises

DBAG turns focus to proprietary dealflow as auctions slowdown

Valuations could cool off as debt availability tightens, German GP's partner Thilo-Anyas Koenig tells Unquote

EQT on track for 2023 final close for Fund X

GP has so far raised more than EUR 16bn for the vehicle against EUR 20bn target

Series A rounds likely bright spots in VC investing in Q1 2023 – KPMG

Energy security, ESG deals to continue apace, with consumer-focused businesses seeing most strain

Certior Capital holds first close for second PE emerging managers fund

Fund has a EUR 80m target and will be split evenly between fund investments and co-investments

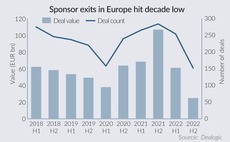

Going, going, not gone: PE auctions bid for relevance amid risk-off environment

With a debt financing drought and macro woes denting exits, GPs are adapting the traditional M&A auction in favour of more flexible bilateral negotiations to get deals across the line

Bellevue eyes Q1 2023 first close for debut secondaries fund

With USD 200m target, vehicle will primarily focus on USD 1m-30m LP stake deals

Montagu exits Maincare to state-owned Docaposte in off-market deal

Hospital software group considered "missing piece" in buyer's healthcare digitalisation strategy

Imbiba holds GBP 70m first close on new growth fund

Leisure, lifestyle and entertainment vehicle has GBP 90m target; first investment completed