Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

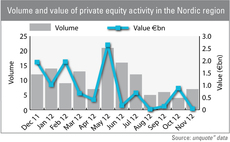

Frozen Nordic market

In just two years, Sweden has lost half of its deal volume, showing that even the popular Nordics are not immune from Europe's economic drag.

ICG invests in Viking

Intermediate Capital Group has made a minority investment in Norwegian roadside assistance provider Viking Redningstjeneste.

Palamon and Sirius buy feelunique.com

Palamon Capital Partners and Sirius Equity have acquired a majority stake in Channel Islands-based online beauty retailer feelunique.com, in a deal that values the business at ТЃ26m.

EBRD loans RUB 1.7bn to Orient Express Bank

The European Bank for Reconstruction and Development (EBRD) has provided Orient Express Bank (OEB) with a three-year loan totalling RUB 1.7bn.

Sofinnova closes seventh fund on €240m

Sofinnova Partners has closed its seventh fund on the vehicle's €240m hard-cap.

PE-backed Walter Services buys Perry & Knorr

HIG Europe and Anchorage Capital portfolio company Walter Services has taken over German customer care business Perry & Knorr.

Trigon aquires 50% of PKM Packaging

Trigon Equity Partners has acquired a 50% stake in German packaging business PKM Packaging from company director Deniz Cevikalp, who retains the remaining shares.

VCs in £3.75m round for Bicycle Therapeutics

Biotherapeutics firm Bicycle Therapeutics has received ТЃ3.75m from existing and new venture capital investors.

FF&P sells US division of Harvest Media

FF&P Private Equity has sold Telescope Inc, the US business of audience participation services firm Harvest Media Group, in a management buyout backed by HIG Growth Partners and Moorgate Partners.

HitecVision sells Spring Energy Norway to Tullow Oil

HitecVision has sold its 87.6% stake in Spring Energy Norway to London-based exploration company Tullow Oil for approximately $326m.

Triton ups European Directories stake

Triton Partners has increased its stake in commercial search directory business European Directories to 50.1%, following the company's debt restructuring.

Fundraising gets personal

Fundraising gets personal

HTGF backs Sota Solutions

High-Tech Gründerfonds (HTGF) and Gundlach Group have supported Berlin-based software developer Sota Solutions with seed financing.

DBAG buys Plant Systems & Services PSS

Deutsche Beteiligungs AG (DBAG) has invested €5.6m for a 49% stake in German newco Plant Systems & Services PSS, with a further financing slated for the short- to medium-term.

FF&P takes minority stake in Sohonet

FF&P Private Equity has taken a minority stake in British media data management business Sohonet.

Vitruvian-backed Tinopolis buys Firecracker and Passion Distribution

Vitruvian Partners' TV production company Tinopolis has snapped up UK-based independent film production company Firecracker Films and global media distribution company Passion Distribution within the first week of December.

Sponsored Video: P2Ps within reach – if prepared

Video: P2Ps

Partners Group closes oversubscribed €2bn secondaries fund

Partners Group has closed its latest private equity secondaries fund at its hard-cap of €2bn before the end of the fundraising period.

Karmijn Kapitaal backs MBO of YouMedical

Karmijn Kapitaal has invested in Dutch medical equipment company YouMedical as part of an MBO.

Mobeus quadruples dough on garlic

The sale of Brookerpaks Ltd back to its management after a 10-year courtship sees Mobeus generate a 26% IRR.

Sberbank and Credit Suisse abandon buyout fund plans

OAO Sberbank and Credit Suisse Group have abandoned plans to raise a $1bn buyout fund dedicated to private equity in Russia.

Investindustrial invests in Aston Martin

Italian GP Investindustrial has acquired a 37.5% stake in UK car designer and manufacturer Aston Martin for тЌ190m from Kuwaiti investment house Investment Dar.

Apollo acquires Aurum Holdings

Apollo Global Management has acquired British jewellery retail Aurum Holdings from Landesbanki Уslands.

One Equity Partners considers Turkish chem business

One Equity Partners and the Turkish army pension fund Oyak have been bidding to buy a stake in Turkish chemicals firm Akdeniz Kimya, according to reports.