Consumer

Cinven buys Restaurant Brands Iberia in EUR 1bn-plus deal

RB is the master franchisee for the Burger King brand in Iberia

Equistone sells Bruneau to Towerbrook

Earlier media report put the EV of the French online office supplies retailer at EUR 475m

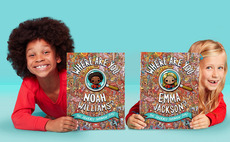

Graphite Capital acquires Wonderbly

Personalised children's books publisher is the seventh deal from Graphite's 2018-vintage ninth fund

Alpha Private Equity sells Vertbaudet to Equistone

SBO of the children's clothing and accessories retailer is Equistone's sixth platform deal of 2021

Apax advised by UBS on Wehkamp exit

Dutch online warehouse Wehkamp is expected to come to market in H2 2021

Palamon exits Feelunique in GBP 132m sale to Sephora

Palamon acquired the UK-headquartered online beauty products retailer for GBP 26m in 2012

De Cecco attracts interest from ProA Capital, denies talks

Private equity firm is keen on acquiring a minority interest in the pasta maker, sources say

A&M Capital Europe buys Pet Network for EUR 260m

Pet Network was created by TRG in 2018 through the acquisition and merger of three businesses

Ermenegildo Zegna merges with Investindustrial-backed Spac

Merged entity will have an anticipated initial enterprise value of USD 3.2bn

McLaren confirms GBP 550m fundraising led by Saudi Arabia, Ares

Existing shareholders, including Mumtalakat, and new private investors invest GBP 150m

CVC Credit finances Livingbridge's World of Books buyout

Livingbridge bought the UK-based online reseller of secondhand books from Bridges Fund Management

Verdane steps up DACH activity with four new investments

GP has made a growth investment in Meister and majority investments in PremiumXL and Remember

Permira makes EUR 1.9bn investment in Adevinta

Deal will see eBay decrease its stake in Adevinta as part of the acquisition of eBay Classifieds

Seraphine lists in London seven months after Mayfair deal

IPO gives the maternity clothing business a market cap of GBP 150m, raising gross proceeds of GBP 61m

H&F, BlackRock, GIC invest in Belron at EUR 21bn EV

Hellman & Friedman (H&F), BlackRock and GIC are to acquire a 13% stake in vehicle glass repair and replacement firm Belron in a deal that gives the company an enterprise value of EUR 21bn and an equity value of EUR 17.2bn.

Morrisons rival bidders may have little room to improve on Fortress bid

Both CD&R and Apollo are seen as viable threats to Fortressтs offer, one source says

VR Equitypartner sells Megabad stake to FSN Capital

VR Equitypartner has sold its stake in Germany-based online bathroom fittings and furniture retailer Megabad to FSN Capital.

Eurazeo to sell early education business Grandir to InfraVia

Eurazeo is set to earn a 2x return on its initial investment

True holds £275m final close for third fund

Consumer-focused GP raised the fund in a six-month virtual process and surpassed its ТЃ250m target

Apollo confirms interest in Morrisons bid

PE firm would have to top a ТЃ9.52bn EV offer from a Fortress-led consortium made over the weekend

Charterhouse buys Labelium from Qualium

B2B digital marketing agency made six add-ons during Qualium's three-year investment period

CapMan acquires Verdane's MM Sports

Verdane mandated Clearwater International in Q1 to assess its exit options

CapMan exits Solera Beverage Group to trade

Exit comes a decade after CapMan acquired a majority stake in Solera alongside co-investors and the management

Unigestion holds €611m final close for second Direct fund

Fund surpasses its тЌ600m target and is more than 40% deployed