Healthcare

YFM and EV reinvest in Peckforton Pharmaceuticals

YFM Equity Partners and Enterprise Ventures have joined the management in investing over ТЃ1m in portfolio company Peckforton Pharmaceuticals.

Synova Capital acquires TAG Medical

Synova Capital's portfolio company dbg, service and product provider to the dental sector, has acquired medical equipment firm TAG Medical.

Sovereign portfolio company acquires Sage Care

Sovereign Capital portfolio company City & County Healthcare Group has completed the bolt-on acquisition of care provider for the elderly Sage Care in a transaction funded from the companyтs existing balance sheet.

HTGF and Bayern Kapital back seiratherm

High-Tech Gründerfonds (HTGF), Bayern Kapital and a strategic partner have announced their intention to invest in medical equipment firm seiratherm.

PE-backed EOS Imaging in €120m IPO

French medical devices business EOS Imaging, a portfolio company of Edmond de Rothschild Investment Partners (EdRIP) and NBGI Ventures among other investors, has listed on NYSE Euronext.

MKB+ invests €3m in Aeon Astron Europe

Innovatiefonds MKB+ has made the first venture investment in Dutch biotech company Aeon Astron Europe.

August-backed Active Assistance acquires Neural Pathways

August Equity LLP portfolio company Active Assistance, a clinical care services provider, has acquired rehabilitation therapy provider Neural Pathways Limited from managing director Vikki Gilman.

Doughty Hanson acquires USP Hospitales for €355m

Doughty Hanson has acquired Spanish hospitals operator USP Hospitales from Barclays and Royal Bank of Scotland for €355m, 9x the firm's forecast EBITDA for 2012.

RJD reaps 1.5x on partial exit from Raphael Healthcare

RJD Partners has partially exited Raphael Healthcare in a refinancing, which has returned 1.5x of the original investment.

High-Tech Gründerfonds backs OakLabs

High-Tech Gründerfonds has invested in German biotech company Oaklabs.

Advent Life Sciences leads series-A for CN Creative

Advent Life Sciences has injected ТЃ2m of series-A funding into British healthcare equipment developer CN Creative.

Altima and Finance Wales back Acuitas with €1m+

Welsh medical company Acuitas Medical Limited has secured a funding round of just more than тЌ1m from private and institutional investors including Altima Partners and Finance Wales. According to Acuitas, the funding round was oversubscribed.

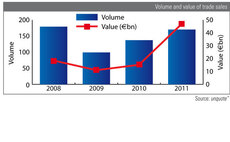

2011 exits: trade sales almost triple in value

As the graph shows, the proportion of trade sales, the most common exit route, has not changed significantly between 2010 and 2011.

Axis invests in Industrias Hidráulicas Pardo

Axis Participaciones Empresariales has invested an undisclosed amount in hospital equipment manufacturer Industrias Hidráulicas Pardo, part of the Grupo HCS and a portfolio company of MCH Private Equity.

Baring exits Centro Inmunológico de Cataluna

Baring Private Equity Partners has completed the exit of medical diagnostics company Centro Inmunológico de Cataluna (CIC) through a trade sale to French medical diagnostics company Labco.

Waterland PE backs Omega Pharma take-private

Waterland Private Equity has backed the take private of over-the-counter pharmaceuticals company Omega Pharma.

Sentica's Arjessa Group bolts on Jokilaakson Perhekodit

Sentica's portfolio company, child welfare service provider Arjessa Group, has acquired trade player Jokilaakson Perhekodit (JP) in a share-swap.

BaltCap backs Labochema

BaltCap has completed an investment in pan-Baltic laboratory supplies and services provider Labochema Company Group. Financial details of the transaction remain undisclosed but investment was under тЌ3m in exchange for a significant minority stake.

Fondo Italiano makes €20m investment in TBS

Fondo Italiano di Investimento has invested €20m in integrated clinical engineering and health services provider TBS Group. The public-private government-backed vehicle has acquired a 13.17% stake in the listed company through a capital injection of €10m...

HTGF backs Eyesight & Vision

High-Tech Gründerfonds and Bayern Kapital have funded a first round of financing for Eyesight & Vision.

Nazca acquires majority stake in Grupo IMO

Nazca Capital has acquired a majority interest in Spanish radiotherapy services provider Grupo IMO via the purchase of shares and a capital injection.

Apax and Nordic Capital-owned Capio acquires three clinics

Apax Partners and Nordic Capital's portfolio company Capio AB has acquired the French Aguilera, and Swedish CFTK and Avesina clinics.

Mid Europa buys Teresa Fryda Laboratory

Mid Europa Partners has acquired Dr. n. med. Teresa Fryda Laboratorium Medyczne Sp. Z o.o. (“Fryda”) as part of its plans to consolidate the Polish laboratory market.

Carlyle Group's Marle International acquires Deloro Stellite

Marle International, a French medical equipment business backed by The Carlyle Group, has acquired ATS Sferic, the non-core medical division of Deloro Stellite, owned by Duke Street Capital.