Healthcare

Redmile, Sofinnova invest £26.3m in Redx

Redmile has agreed to subscribe for 11.5 million new ordinary shares for 11.2 pence per share

Alvia buys majority stake in Hamburg Care

Acquisition of a majority stake in the Germany-based care provider marks the firm's first investment

Khosla leads $9m series-A extension for Sword Health

Vesalius Biocapital, Green Innovations, Founders Fund and Faber Ventures also take part in the round

SHS buys minority stake in Blazejewski Medi-Tech

Deal for endoscope manufacturer marks the final investment from SHS Fonds IV

Bain- and Cinven-backed Stada buys 15 GSK brands

Deal is part of Stada's growth in the consumer health and over-the-counter sectors

PE still hungry for retirement homes, but infra funds loom

Eight deals were completed in the retirement homes sector across Europe in 2019, above the annual average of five since 2014

Aksia-backed Primo invests in L Catterton's CareDent

Combined group will operate a network of 155 dental clinics and generate revenues of around €100m

Praetura leads £7m round for Inotec

Praetura is currently investing from its EIS 2020 Fund, which closed on ТЃ7m in February 2020

KKR-backed Gamma takes stake in Univercells subsidiary

KKR's $50m investment in Univercells will be drawn from its Health Care Strategic Growth Fund

Palatine sells Vernacare to HIG

HIG is currently investing from Growth Buyout Equity Fund III, which closed on $970m

Vesalius, Swisscanto in €19m series-B for OncoDNA

Fresh capital will be used for international growth and software development acceleration

Main Capital sells TPSC to PE-backed Symplr

Sale ends a six-year holding period for the GP, which bought TPSC via its €40m Main Capital III fund

DPE sells stake in PharmaZell to Bridgepoint

Deutsche Private Equity invested in the company in 2013 and began the sale process in August 2019

Amundi PEF, SGCP back Vivalto Vie in capital reshuffle

Azulis Capital exits the care home operator, having backed it since 2015

Nexxus Iberia buys Grupo Bienzobas

Fifth investment made by the GP via its first Spanish fund, Nexxus Iberia Private Equity Fund I

Fountain Healthcare invests €5m in Inotrem

In addition, Inotrem receives a €13m credit line from Kreos Capital and a €1m loan from BPI France

Cerberus sells Covis Pharma to Apollo

Sale ends a nine-year holding period for the GP, which built Covis through a series of acquisitions

Consortium in CHF 23m series-C for Lunaphore

Fresh capital will be used for market and product expansion in the US and Europe

PVP fully acquires Avenir Medical Poland

In May 2018, PVP acquired an initial 56% stake in AMP from the company's founders

Management retains control of Ceva Santé Animale in 5th buyout

Historic transaction is one of the largest-ever French LBOs, and the largest ever led by a management team

Ergon-backed Opseo buys ZBI NRW

Regional group was previously part of ZBI and will open new clinics in North Rhine-Westphalia

ICG transfers Esperi ownership to lenders

Esperi will be owned by a new parent company controlled by Danske Bank, Ilmarinen and SEB

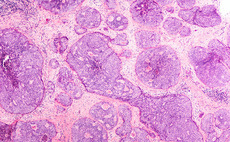

GHO backs Portuguese biotech company FairJourney

GP invests from its GHO Capital Fund II, which held a final close on its €975m hard-cap in November 2019

MTIP et al. exit Blueprint Genetics to trade

Listed, US-based diagnostic information service Quest Diagnostics has acquired Blueprint