Sector

The Bolt-Ons Digest – 17 April 2023

Unquoteтs selection of the latest add-ons with Triton's BFC Group, Seven2's Groupe Crystal, Palatine's FourNet and more

Vitruvian pivots to unstructured talks for OAG amid valuation pressures

Airline data provider drew early interest from sponsors when sale process kicked off earlier in 2023

Montagu-backed intel provider Janes attracts takeover interest amid defence spending boom

Formal auction for the security and defence intelligence specialist unlikely to start before early 2024

Metric Capital and Scope acquire majority stake in Maileg

Deal for Danish toy brand marks second investment this year out of Metricтs fourth fund, which is now about 85% deployed

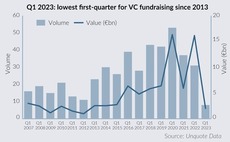

VC fundraising sinks further with lowest Q1 in a decade

Eight European firms secured just over EUR 2bn in commitments in Q1 2023 as continuing uncertainty suppresses LPsт risk appetite, but fundraising pipeline looks promising

Wellspect bidders CVC, KKR, PAI, EQT expected to progress into second round

US trade owner attempted a previous sale for the Swedish bladder and bowel-control products specialist in 2018

Charterhouse transfers Sagemcom to AlpInvest-backed continuation fund - filings

GP will make a return of over 5x MOIC on the deal for French telecoms business

Houlihan Lokey hires new capital markets MD from Numis

David Kelnar told Unquote that the firm is seeing a growing pipeline of companies looking to fundraise

Procuritas raises EUR 407m for PCI VII

Swedish GP's seventh fund is 28% larger than predecessor and will invest in Nordic buyouts

Hunter Point buys minority stake in Coller Capital

Proceeds from the deal will be invested into secondaries investor Coller Capitalтs funds

Spending bottom dollar: Valuation gaps take Q1 buyout levels back to 2009

Sponsors make just 95 buyouts in Europe in the first quarter - a figure not seen since Sony sold 12m floppy discs in one year

HIG Capital acquires Office People

German staffing agency will seek to grow organically, as well as via add-ons and selective internationalization

LDC appoints Houlihan Lokey for Kerv sale

LDC backed IT managed services firm's formation via a two-company merger in 2020 with a GBP 30m investment

PE roll-up strategies face regulatory heat with focus on consumer industries

With longer holding periods facilitating more bolt-ons, regulators including the UK's CMA are intervening

MJ Hudson business divisions acquired by Apex Group

Sale follows suspension of listed UK-headquartered asset management service providerтs shares in December 2022

Quadrivio reaps 40%-plus IRR, 2.2x cash-on-cash from EPI sale

Trade sale of Italy-based sports merchandising specialist marks Industry 4.0 fund’s first exit

Inflexion sells GP stake to Hunter Point Capital

10% stake in UK-based midmarket sponsor is the first European deal for US-based GP stakes investor

VC Profile: Hi Inov in pre-marketing for next fund, outlines plans to wrap up Fund II investment period

France and Germany-based early-stage investor has made 15 of its up to 20 planned investments from its EUR 100m Fund II

GP Profile: Metric Capital confident of structured capital strategy demand with multiple exits in pipeline

UK-based sponsor banks on appeal of its strategy as an alternative to private equity and debt providers

KKR holds USD 8bn European Fund VI buyout fund close with 12.5%-plus GP commitment

European Fund VI will deploy equity tickets of EUR 250m-750m in six core sectors

ECI reaps 2.7x return on 4ways sale to EQT-backed Evidia

Sale process for UK-based teleradiology platform had been running since September 2022

V.Group sponsor Advent explores strategic options, appoints Goldman Sachs and Jefferies

Sponsor bought the UK-based marine servicing firm from OMERS Private Equity six years ago

Infravia aims to raise up to EUR 1bn for next growth fund, eyes mid-2024 launch

French sponsor expects to raise EUR 750m-EUR 1bn for B2B tech-focused second growth fund

BC Partners acquires Metropolitan College, AKMI IEK in second deal from Greece-focused fund

Sponsor will support the post-secondary education provider with organic growth, plus add-ons in the Balkan region