Sector

EQT's Top-Toy files for restructuring

Restructuring plan includes closing down unprofitable stores and letting go up to 450 employees

RJD reaps 92% IRR on Barber of Sheffield exit

RJD Partners acquired a majority stake in Barber of Sheffield just two years ago

Lightpoint Medical raises £5m

Cambridge Capital Group, Venture Founders and Coutts Investment Club were among the investors

Sequoia leads $24m series-B for Tourlane

Existing investors Spark Capital, Holtzbrinck Ventures and DN Capital also take part

Brockhaus buys Palas

CEO Maximilian Weiß, who is also a minority shareholder, will continue to hold a significant stake

Omers-backed Trescal makes two overseas bolt-ons

French calibration services specialist buys Texas-based MATSolutions and Asia-based NorthLab

Ciclad backs VitrineMedia OBO, Siparex exits

Previous backer Siparex sells its minority stake in the business, having invested €1m in 2013

Parquest et al. carve out Sopral from Avril Group

Parquest, Idia Capital Investissement, Agro Invest and Unexo acquire stakes in Sopral

Project A targets Q1 final close for third fund

New vehicle was registered in Berlin as Project A Ventures III GMBH & Co KG in October

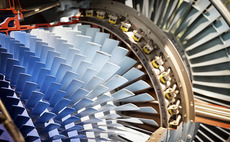

French PE investment in aerospace soars to new heights

Asset class is fuelling growth in the industry, with aggregate value in France picking up pace in recent years

Arkéa et al. buy Malherbe from Siparex, NCI

Consortium of backers buy a minority stake in the logistics and transport specialist

Afinum and Invision team up for Ledlenser deal

Afinum is the lead investor, with Invision and the company's management team also participating

Vertis, StarTIP lead €7.8m round for Buzzoole

Previous backers R301 Capital and Impulse VC also took part in the funding round

Highland injects €25m into Camunda

Open source workflow automation software developer will pursue international expansion

One Equity Partners-backed Inside Secure buys Verimatrix

GP participates in the equity financing with a view to becoming the cornerstone investor of Inside Secure

Insight leads $30m series-C for LeanIX

Software developer will pursue international expansion and invest in new products

Nord buys two companies, creates Norwegian healthcare group

Companies will become part of Helsepartner Nord-Norge, a new healthcare group created by the GP

FSN buys Rameder from Findos

First deal FSN has completed in Germany since setting up a Munich office in March this year

NB Renaissance-backed Comelz bolts on Develer

Company will use the investment to open a new business unit focused on research and development

Nazca Capital buys Terratest from Platinum Equity

Company plans to use the fresh capital to further expand internationally, especially in the US

Core-backed TEG buys GTA

First bolt-on the company has made since Core acquired the business in November 2016

AP1 leads SEK 300m round for Acast

AP1 is joined by Swedbank Robur funds Ny Teknik and Fokus Fund, which also invested in the series-B

LSP leads $28m round for Lumeon

Healthcare software company will expand its US operations and invest in marketing

FitLab et al. in $45m series-A for Freeletics

Courtside Ventures, Elysian Park Ventures and Ward.ventures also take part in the round