Sector

North West Fund backs Dot Medical

The North West Fund for Biomedical, managed by Spark Impact, has invested ТЃ550,000 in Dot Medical, which manufactures equipment to treat heart conditions.

Key Capital Partners backs £15m MBO of Nurse Plus

Key Capital Partners has backed the ТЃ15m MBO of UK-based healthcare staffing company Nurse Plus.

ISIS invests £5.2m in Pho

ISIS Equity Partners has committed to a ТЃ5.2m staged investment in independent UK-based Vietnamese street-food group Pho.

Azulis and Galia inject €15m into Bio-Clinic

Azulis Capital and Galia Gestion have invested a joint €15m in French medical analysis laboratory Bio-Clinic.

Dunedin's CitySprint acquires Scarlet Couriers

UK-based distribution network CitySprint, backed by Dunedin Capital Partners, has acquired courier firm Scarlet Couriers.

Endless edges closer to Pizza Hut deal

Turnaround specialist Endless is in exclusive talks to acquire the UK business of Pizza Hut from parent company Yum! Brands, according to reports.

Hutton Collins and LGV back Novus Leisure MBO

Hutton Collins and LGV Capital have backed the management buyout of bar and club operator Novus Leisure, which notably runs the Tiger Tiger brand.

N+1 makes 3.5x on ZIV sale

N+1 Private Equity has sold its 75% stake in Spanish digital equipment and services provider ZIV Aplicaciones y Tecnología to trade player Crompton Greaves for €150m.

Equistone sells Kermel to Qualium

Qualium Investissement has acquired a majority stake in French fibre manufacturer Kermel from Equistone Partners Europe, which is understood to have reaped a 2.2x money multiple on the sale.

AXA PE acquires Fives from Charterhouse

AXA Private Equity has backed the management buyout of industrial engineering firm Fives Group in a deal that values the company at around €850m.

Finance Wales et al. complete Clinithink series-A

Finance Wales has taken part in the multi-million-dollar second tranche of a series-A funding round for UK-based healthcare software company Clinithink, alongside existing investors.

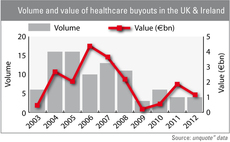

Are buyout firms well placed for healthcare reforms?

UK healthcare

Hony and GCS named preferred bidders for Dexia unit

Chinese private equity houses Hony Capital and GCS Capital have teamed up to buy the asset management arm of Dexia in a deal worth €500m, according to reports.

LDC takes Boomerang private

LDC has acquired AIM-listed media production company Boomerang in a take-private worth close to ТЃ8m.

North West Fund backs PlaceFirst

The North West Fund for Energy & Environmental, managed by CT Investment Partners, has acquired a minority stake in UK-based energy and regeneration business PlaceFirst.

Slovakia looking to take over Penta-backed Dôvera

Slovakian prime minister Robert Fico is mulling a takeover of two private health insurance companies, in a move that could threaten Penta's investment in Dôvera.

Mid Europa backs Walmark

Mid Europa Partners has acquired a 50% stake in Czech dietary supplements manufacturer Walmark from the company's founders.

Cross acquires Micromacinazione

Swiss firm Cross Equity Partners has acquired a majority stake in Swiss micronisation technologies and services company Micromacinazione.

Siparex takes 25% stake in Vulcain

Siparex has acquired a minority stake in the owner buyout of French building fixtures manufacturer Vulcain.

MBO Partenaires buys 80% of LMB

MBO Partenaires has taken a majority stake in the management buyout of French aerospace parts supplier LMB.

RCapital Partners backs bChannel MBO

RCapital Partners has supported the MBO of UK sales channel management business bChannel.

IK buys Actic from FSN Capital

IK Investment Partners has acquired Swedish health and fitness business Actic from FSN Capital.

T-Venture backs DropGifts

T-Venture has backed Berlin-based social gifts start-up DropGifts with a seven-digit-euro investment.

Activa's Ergalis acquires three businesses

Ergalis, a build-up platform created by Activa Capital, has acquired French temporary employment agencies and recruitment services businesses Action Beauté Cosmétique Interim, Action Assistance and Talentpeople.