Technology

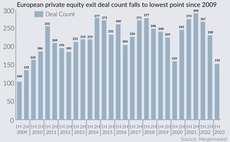

European SBOs sink to lowest level since GFC, leaving sponsors weighing exit options

Hopes for exits comeback pinned on M&A uptick and shift in valuation expectations in 2H 2023

Capza sees solid demand for Flex Equity strategy as fifth fund reaches two-thirds deployment

GP is seeking bolt-ons for French consulting firm Neo2 following fresh minority investment, partner Fabien Bernez said

Cinven emerges as frontrunner for ICG's With Intelligence

ICG aims to sign deal for financial data and intelligence provider by end of next week

Esquare Capital Partners seeks entrepreneur commitments for second, EUR 25m tech platform

Dutch investor aims to connect entrepreneurs with tech investment appetite to startups seeking capital

Federated Hermes raises USD 486m for fifth co-investment fund

Fund surpassed its USD 400m target; its 2018-vintage predecessor raised USD 600m against a USD 350m target

PE purchases stall in Italy as buyers lose faith – PE Forum Italy

PE players are hoping that valuation expectations will align in 2H 2023, easing dealmaking backlog

FPE Capital acquires, merges NoBlue and Elevate2

GPтs investment in NetSuite partners marks fifth investment out of third fund

Seven2 to launch 11th fund in next 18 months as fundraising normalcy nears

Fundraising could pick up by year-end as LP denominator effect continues to wind down

Nordic Capital reaps around 6x money in Macrobond SBO

US-based tech sponsor Francisco Partners set to acquire the Swedish financial data provider

SGT Capital focuses on co-investments and LP diversification in next stretch of USD 2bn fundraise

Co-managing partner and former Mormon missionary turned financier Joseph Pacini speaks to Unquote as the firm’s current fund nears a USD 1bn-plus second close

Macrobond owner Nordic Capital collects initial bids in wide sale process

Nordic Capital is expected to collect non-binding offers for Swedish financial data company Macrobond this week, two sources familiar with the situation said.

Arcven Capital to raise debut VC secondary purchase fund with EUR 80m target

VC aims to provide liquidity to existing startup shareholders, investing EUR 200,00-EUR 2m at discounted valuations

Summa Equity's Documaster tipped as likely exit candidate for 2024

GP bought a majority stake in Norway-based digital document platform provider in 2017

GP Profile: NB Renaissance outlines acquisition and exit plans in final stretch of current fund deployment

Nearing full deployment for its third fund, Italian private equity firm is prepping one more deal and at least one exit by year-end

Dutch sponsor Egeria gears up for new fund launch next year

GP’s 2017-vintage, EUR 800m current fund is expected to be fully deployed within 12-18 months

HLD's 52 Entertainment sale on hold over valuation issues

French gaming developer had been expected to see a valuation of at least 15x EBITDA

AnaCap exits GTT to Stirling Square

Vendor will reinvest in tax collection software for a 20% stake; buyer makes second tech deal in a month

Wellington eyes late-stage growth opportunities with new USD 2.6bn fund

GP seeks to address capital needs pre-IPO or sale and anticipates a diverse portfolio for fourth fund

The Bolt-Ons Digest - 3 July 2023

Unquoteтs selection of the latest add-ons with Palatine's Anthesis, Nordic Capital's Regnology, Waterland's Janssen and more

Quadrivio rounds off Industry 4.0 Fund deployment with Twist acquisition

Acquisition of the Italian reconditioned tech hardware business is the last from the EUR 200m vehicle

Cathay holds final close on USD 270m for PE growth fund

France-based GP’s latest private equity fund expands its geographical focus to North America

VC Profile: NetScientific's EMV gears up for debut fund targeting early-stage deep-tech startups

UK-based investment platform will step up investments in existing portfolio, while securing commitments for its thematic fund by year-end

RTP Global holds final close for fourth fund on USD 1bn

Fundraise is New York-headquartered early-stage venture capital firmтs largest to date

Volpi raises EUR 250m continuation vehicle for 2016-vintage assets

Volpi Capital Investments Conti will hold Dutch geospatial data company Cyclomedia and UK-based surveillance group Digital Barriers