PE purchases stall in Italy as buyers lose faith – PE Forum Italy

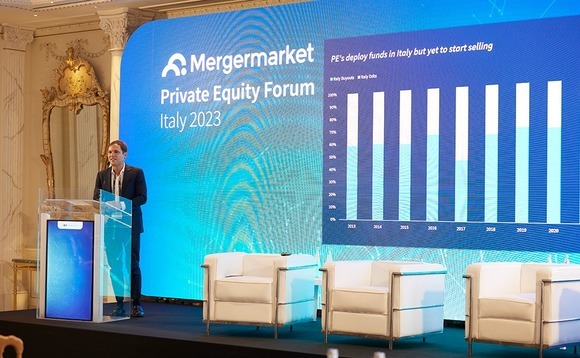

Sponsor acquisitions in Italy have largely stalled as private equity (PE) buyers are no longer willing to pay a premium for growth given an uncertain economic outlook, but many are holding out hope for an uptick in activity in 2H 2023, delegates told Mergermarket’s Private Equity Forum Italy 2023.

Dealmaking is increasingly challenging, with less appetite from debt underwriters to finance deals, higher cost of capital, performance volatility, imbalances in valuation expectations, slow PE fundraising and macroeconomic uncertainty, noted Matteo Zenari, head of financial sponsor group at Intesa Sanpaolo.

The feeling at the conference was that many sellers have not caught up with the times.

Advent International managing director Francesco Casiraghi said that investment strategies are changing due to the requirement for less financial leverage and heightened cost of capital. However, he noted that in a difficult market, a correction of previously unrealistic valuations becomes possible.

"The decision to sell is often done in previous years, when the world was in a different economic environment," he noted.

Funds are taking on a "disciplined strategy", asking themselves if targets not only boast strong financials but also whether they can be sustained in the long term.

To this end, they now deconstruct performance during due diligence, which can extend the preparatory phases in an auction process, explained Valentina Franceschini, senior partner at mid-market fund Wise Equity.

The desire of owners to monetise their growth has often led to valuation misalignment when faced with the high scrutiny of buyers. As reported, market instability led Palladio to suspend the sale process of Unigasket, an Italian manufacturer of industrial pipes and gaskets, with the auction paused due to a valuation mismatch with the undisclosed bidder.

Italian veggie-burger producer Kioene's second attempt at a sale has also been put on hold, as the dossier saw lukewarm interest due to the company's average performance and high valuation expectations. Last month, Italian pet foods producer Morando put its search for an investor on ice as offers did not meet valuation expectations. Several prospective bidders considered the proposed EUR 300m deal value too ambitious.

Even if a mutually acceptable valuation can be found, lenders will also need to be convinced of a target as a viable business in the long term. This means that debt financing is not available for all assets, so it is important to focus on debt feasibility early on and analyse an asset's business plan and sensitivities, suggested PwC partner Alessandro Azzolini, including impact on cash flow in a worst-case scenario and alternative liquidity options.

New techniques

To ease the backlog of new dealmaking, tools are being explored to make deals viable and ensure that performance targets are met amid uncertainty.

Some strategies include staggered earn-out clauses based on performance, said Andrea Giardino, equity partner at Gatti Pavesi Bianchi Ludovici, whereby part of the payment for the asset is held back until the performance targets are hit.

Delayed earn-outs allow sponsors to bridge valuation gaps, although these come with the disadvantage of postponing the realisation of the investment for the seller.

Sponsors can also ensure a successful exit by running asset viability assessments and stress tests during their preparation phase; at Unigestion this process is now backed by an industry expert from a proprietary network of advisors, said Francesco Aldorisio, a partner at the firm.

There were hopes at the conference that 2H will yield more deals once valuation expectations align.

"When the first one sits at the table, others come," Casiraghi noted, but cautioned that a true uptick might only follow in early 2024. "Historically, the investments done in years of low M&A became the best deals later. Companies which previously had impossible valuations later became more feasible deals," he said.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds