Technology

InvestIndustrial closes third lower mid-market fund on EUR 1.1bn

Strategy will target businesses in Italy, Spain, Portugal and Switzerland with internationalisation potential

Warburg Pincus broadens Once For All sale to sponsors ahead of launch

Information memoranda expected in the coming weeks for the supply chain risk-management software firm

Carbon Equity open to commitments for new impact fund with EUR 125m hard-cap

Netherlands-based fund-of-funds manager will broaden its strategy to incorporate co-investments for its second fund

VC Profile: Klima lines up green energy deals from EUR 210m debut fund

Franco-Spanish Alantra and EnagУЁs-backed VC initiative expects to lay the foundations for its second fund in 2024

Ardian's d&b audiotechnik to hit market in 2023 as large-cap sponsors circle

GP acquired the audio equipment maker in 2016 from Cobepa and Odewald & Compagnie for around EUR 300m

Women in VC: MMV's Brunet on tech opportunities and navigating volatile markets

Alix Brunet speaks to Unquote about the VC firmтs deal pipeline and how it is engaging with portfolio companies and new founders

Gimv acquires majority stake in Witec

Belgium-based Gimv set to support Netherlands-headquartered contract design manufacturer’s growth

Newly launched Utopia Capital aims to deploy EUR 10m-plus by 2028

Angel investor Christian Schroeder's new investment vehicle will support early-stage tech companies addressing humanitarian issues

VC Profile: HTGF optimistic on seed stage opportunities as exit environment toughens

German seed investor secured almost EUR 500m for its fourth and biggest fund to date at a time when VC funding is slowing down

EQT exits Kfzteile24 to management, investor consortium

Sale of German car parts e-retailer wraps up EQT’s inaugural 2013-vintage Mid Market fund

Women in PE: Foresight's Alvarez on SME deployment plans, regional expansion drive

Partner Claire Alvarez speaks to Unquote about opportunities in the current market and the UK-based sponsorтs diversity ambitions

4Impact heads for year-end close for EUR 125m second fund

Founded by ex-Goldman Sachs team, impact VC firm has made one investment from its latest fund so far

Bregal Milestone prepares Epassi exit via JP Morgan

Bregal Milestone has held a majority stake in the Finnish employee benefit platform since 2019

The Bolt-Ons Digest – 17 April 2023

Unquoteтs selection of the latest add-ons with Triton's BFC Group, Seven2's Groupe Crystal, Palatine's FourNet and more

Vitruvian pivots to unstructured talks for OAG amid valuation pressures

Airline data provider drew early interest from sponsors when sale process kicked off earlier in 2023

Montagu-backed intel provider Janes attracts takeover interest amid defence spending boom

Formal auction for the security and defence intelligence specialist unlikely to start before early 2024

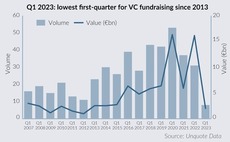

VC fundraising sinks further with lowest Q1 in a decade

Eight European firms secured just over EUR 2bn in commitments in Q1 2023 as continuing uncertainty suppresses LPsт risk appetite, but fundraising pipeline looks promising

Charterhouse transfers Sagemcom to AlpInvest-backed continuation fund - filings

GP will make a return of over 5x MOIC on the deal for French telecoms business

Procuritas raises EUR 407m for PCI VII

Swedish GP's seventh fund is 28% larger than predecessor and will invest in Nordic buyouts

Spending bottom dollar: Valuation gaps take Q1 buyout levels back to 2009

Sponsors make just 95 buyouts in Europe in the first quarter - a figure not seen since Sony sold 12m floppy discs in one year

LDC appoints Houlihan Lokey for Kerv sale

LDC backed IT managed services firm's formation via a two-company merger in 2020 with a GBP 30m investment

Quadrivio reaps 40%-plus IRR, 2.2x cash-on-cash from EPI sale

Trade sale of Italy-based sports merchandising specialist marks Industry 4.0 fund’s first exit

VC Profile: Hi Inov in pre-marketing for next fund, outlines plans to wrap up Fund II investment period

France and Germany-based early-stage investor has made 15 of its up to 20 planned investments from its EUR 100m Fund II

KKR holds USD 8bn European Fund VI buyout fund close with 12.5%-plus GP commitment

European Fund VI will deploy equity tickets of EUR 250m-750m in six core sectors