Turkey rises to the challenge

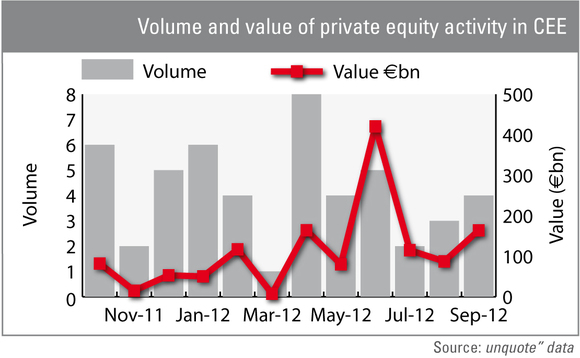

Turkey is slowly but surely establishing itself as a prominent market for private equity in Central and Eastern Europe along with Russia and Poland.

The emerging market acts a pathway to the middle east, while maintaining strong ties with western Europe, making it a more prominent destination for investments.

On Monday, Fitch Ratings upped Turkey's status to BBB, causing the country's 10-year government debt yields to fall from 6.98% to 6.86%.

The more positive rating will make it cheaper for investors to commit capital to Turkish ventures in the long term, as risk premiums will decline.

In Q3, Turkey saw two e-commerce deals: Yemeksepeti.com offers an online food ordering service and Hemenkiralik.com specialises in short-term accomodation.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds