DACH investors turn to value creation to justify high multiples

Private equity houses conducting business in German-speaking countries are needing to adopt new investment strategies in an effort to deliver greater value upon exiting, according to panellists at the Unquote Germany Private Equity Forum 2018.

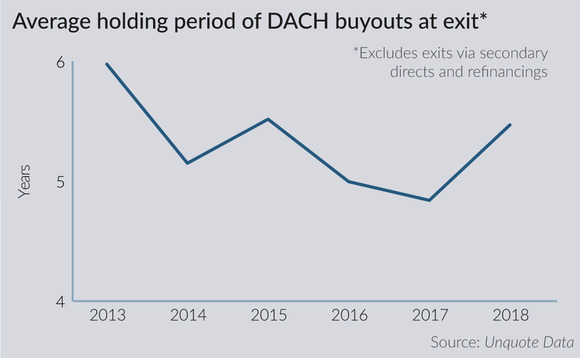

Greater effort is expected from financial investors these days to spend more time, and money, during their holding periods building up businesses to enhance them and extract greater exit multiples. This is particularly the case when looking at conducting bolt-on acquisitions for portfolio companies, said panellists speaking at the Unquote Germany Private Equity Forum 2018 in early June. Such add-on businesses need more time and care to integrate companies, which in turn could lead to longer holding periods and greater flexibility than traditional private equity models, they added.

Evergreen funding is not a strategy often associated with German private equity, but adopting this methodology would allow sponsors to lengthen the time they own a company, the panellists argued. This, in turn, could create better value, having more closely guided the company's growth and teed it up for further success under new ownership.

Three of the five most active private equity firms based in the DACH region last year used non-standard investment models, according to Unquote Data. Aurelius Equity Opportunities uses a listed industrial holding structure, while Hannover Finanz uses a range of evergreen vehicles and Perusa Partners recently revised plans for a new buyout fund in favour of a more bespoke vehicle with a longer fund life.

While some firms have established specific funds designed to invest differently, others with standard buyout vehicles have simply been holding assets for longer. Palamon Capital Partners sold ophthalmology outpatient chain Ober Scharrer Group to Nordic Capital in March after a seven-year buy-and-build strategy that tripled the size of the business. TA Associates sold Austrian dental chain Amann Girrbach to Capvis and Partners Group in April after doubling its size in eight years, while Capvis sold industrial supplier Lista to Chinese trade buyer GreatStar last week to end a near 12-year holding period.

Funds operating in the region should tailor strategies according to each investment, rather than using a one-size-fits-all approach for portfolio firms, panellists agreed. Understanding the needs and motivation of mid-cap companies and communicating with management teams is integral to an asset's turnaround and success, they added.

No more generalists

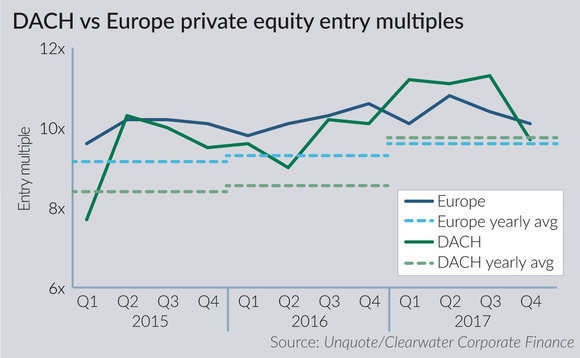

Generalist funds in the DACH region now operate primarily in the large-cap segment of the market, where there are fewer assets to choose from, it was argued. Panellists said it is becoming increasingly necessary for private equity houses to specialise, particularly in today's crowded market. Having sector- or size-specific expertise allows a fund to differentiate from other players and should be more likely to attract niche businesses.

Family offices have similarly adapted to a changing investment environment. The Harald Quandt family, which has a handful of alternative investment vehicles, launched a new initiative at the beginning of the year to exclusively acquire businesses in the micro-cap segment. Harald Quandt Industriebeteiligungen (HQIB) will invest in DACH-based companies making less than €5m EBITDA, managing partner Gregor Harald May said on the sidelines of the Unquote event.

HQIB was a way for the family to move away from the crowded mid-cap market, in which it operates with its buyout firm HQ Equita. Competition for mid-sized businesses in the DACH region has grown fiercer in the last few years, May said. On one side, the segment has attracted the interest of large sponsors, which have set special mid-market funds. On the other side, new entrants, which initially looked at smaller deals, are now raising larger funds and going after mid-sized targets.

Being among a less competitive segment of the market should allow HQIB to pay lower multiples, as competition is less fierce, May said. Moreover, as these are typically primary deals, they could have a clearer path to value creation compared to assets that have been in the hand of other private equity buyers, he said.

HQIB has €100m in equity from the Harald Quandt family. The money is not held in a typical fund structure and does not have a set lifetime, which allows it to hold the companies for longer. In April, it announced its first deal, acquiring Germany-based optical pipe inspection systems developer MinCam.

From a corporate's perspective, specialised funds are also helping change the perception of private equity in the region, making for a more attractive option for sellers, as well as providing more investors to choose from, panellists said.

Additionally, when it comes to Mittelstand companies needing to adapt to digitalisation, private equity can help facilitate this change, acting as an accelerator in the process. Besides money, financial investors can bring expertise and best practices developed at their other portfolio companies.

As large, generalist funds will attest, there is much money still to be made in the large-cap space. But investors looking for lower entry multiples increasingly appear to believe that a tailored approach to smaller assets can pay off.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds