VC fundraising lifts off in DACH region

As DACH-based VC firms Rocket Internet and Lakestar both look to raise their largest funds yet to invest in European startups, Oscar Geen looks at the rise of the asset class in the region

Six venture capital funds based in the DACH region have held final closes in 2018 so far, for a combined value of €1.3bn, meaning the region is on track to break the record for the seventh year running for total value of VC funds raised.

Additionally, there are several significant raises that are still in the market, such as Berlin-based Rocket Internet, which recently launched the successor to its €1bn Rocket Internet Capital Partners I; and Zurich-based Lakestar, which has launched a double fundraise with a combined €800m target, representing a 128% increase on Lakestar II.

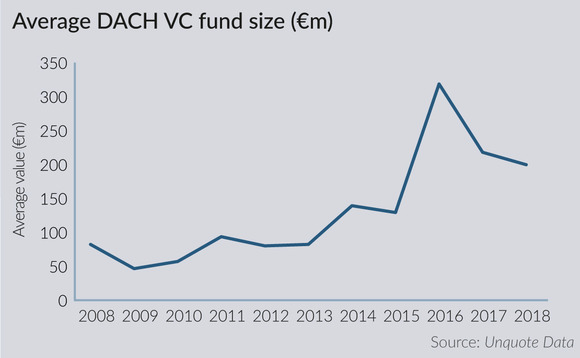

This growth is in line with fund-size increases in the asset class across the DACH region. Between 2008-2017, the average VC fund size more than tripled from €82m in 2008 to €249m in 2017, according to Unquote Data.

Other funds raised this year that have raised significantly more than their previous generations include UVC Partners' UnternehmerTUM Fonds II, which raised its hard-cap twice and ended up with commitments totalling more than three times its predecessor; and Holtzbrinck Ventures Fund VII, which has increased its fund size by 72% since becoming independent in 2010.

Between 2008-2017, the average VC fund size more than tripled from €82m in 2008 to €249m in 2017 – Unquote Data

Ingo Potthof of UVC Partners is wary of taking the statistics at face value, though: "I would be a bit cautious that the average fund size has increased quite as much as the graph shows. A few large vehicles could be distorting it. However, the general trend is upwards and the number of funds and type of investors in venture capital has also increased a lot."

It is clear that VC funds are attracting more LP attention, and not just from German investors. "Our LP base for our latest fund is purely German because we did not go fundraising internationally. However, we do see more interest in German VC generally and international funds-of-funds have selectively made some fund commitments," says Potthof.

Growth trend

Christian Böhler of Unigestion sees the popularity of VC in DACH spilling over into the buyout market: "We see a lot of technology deals in industries such as software, renewable energy and high-value-add engineering, and the bulk of these deals are minority or growth financing, which is mirrored in many funds coming to the market. Compared to some years ago, funds are slightly more focused on specific sectors. However, the market is not really mature or deep enough to play a too-narrow sector approach. Other than technology growth funds, there are not too many."

The trend of buyout firms doing more growth and technology deals has also supported VC firms both directly and indirectly. Says Potthof: "There are also more of the larger growth equity and technology-focused private equity funds. We have co-invested alongside one and have heard of buyout firms acquiring companies from VC firms directly, although we have not done this at UVC yet."

The pipeline for VC fundraising in the second half of the year also looks strong. In addition to Rocket Internet and Lakestar's raises, there are at least five other VC funds in the market, according to Unquote Data. Among these is a fund managed by Berlin-based VC Target Global, which announced at a technology conference earlier in the year that it would launch Europe's first specifically transport-technology-focused fund with a $300m target, perhaps demonstrating a deeper level of maturity and specialisation in the market than some expected.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds