DACH leads lower-mid-market fundraising

Lower-mid-market buyout fund managers in the DACH region have raised more capital in the last year than their counterparts from other European regions. Oscar Geen explores the factors contributing to this period of outperformance

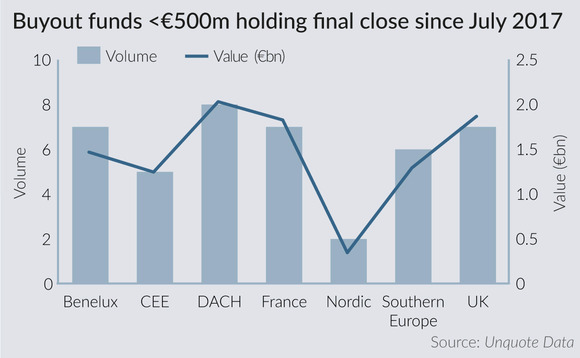

Eight DACH-based buyout funds with a total volume of less than €500m have held final closes for a total of €2.027bn since July 2017, according to Unquote Data. This is more than any other European region by both volume and value, followed by France, which saw seven funds close on a total of €1.824bn.

The lower-mid-market generally is attractive to LPs that are worried about the possibility of a downturn, especially after a sustained period of record deal activity across all sectors and geographies, with consistently high entry and leverage multiples.

ECM Equity Capital Management held a final close on €325m for German Equity Partners V in June 2018, surpassing its €300m target. Bernard de Backer is a partner at the firm and made the same observation during the fundraising process: "It's clear that some LPs are either revisiting or entering for the first time the lower-mid-market. Part of that is being concerned about pricing and leverage levels and the role of shadow capital in the large-cap space."

It's a bit of a myth that German institutions don't invest in private equity" – Bernard de Backer, ECM Equity Capital Management

De Backer lists two reasons that DACH-based GPs have done particularly well out of this in the past year: "Firstly, LPs still see potential for expansion in the DACH lower-mid-market, whereas in the UK and the Nordic countries it is already more saturated." This is borne out in the statistics that show 56 UK-based funds in this bracket held final closes between January 2012 and December 2016, for a total volume of €12.3bn, compared with 26 Nordic funds raising €5.4bn and 21 DACH funds collecting €4.9bn.

"Secondly, Brexit has led to some LPs delaying decisions to invest in the UK, which has benefited funds on the continent to some extent," says de Backer. Anecdotal evidence from the experience of UK-based lower-mid-market fund manager FPE Capital supports this assertion. Speaking on a panel at Allocate, Unquote's pan-European private equity event, managing partner David Barbour said: "Brexit changed everything – the US took a step back and we had to get some momentum going with a couple of deals before reaching final close."

Wanderlust?

It is a commonly held belief that German institutions are less inclined to risk their capital in private equity funds than their Anglo-American and Nordic counterparts, but de Backer is not convinced by this argument. He agrees that "international LPs have been quite supportive, especially mid-sized US pension funds", but adds: "It's a bit of a myth that German institutions don't invest in private equity. Insurance companies are very keen to invest and we've seen growth in funds-of-funds that pool money from both German public and private sources."

Given this increasing demand, the temptation for managers with a good track record is to collect more capital and expand, either into the larger deal brackets or by doing more deals and even expanding geographically. "It's a market where some LPs will let you raise substantially bigger funds but there are also many that caution against that," says de Backer. "Those DACH-based GPs that have managed to raise larger funds could be very well positioned if they succeed, because there's a bit of a gap in the €500m+ bracket, but this is not a given. Historically, some funds in the region have pursued this route and did not succeed, while a select few have."

One placement agent speaking to Unquote on the condition of anonymity agreed with this sentiment and gave examples: "It's true that some DACH-based buyout funds, like DBAG and Deutsche Private Equity, have managed to successfully expand into the €500m+ bracket; but some, like Quadriga and Odewald, have just about made it there and then imploded."

In any case, it is clear that fundraising in the lower bracket is not showing any signs of slowing down. Last month, Steadfast Capital Partners held a first close for its fourth fund on €230m, and expects to hit its €300m hard-cap before the end of the year. Additionally, Swiss firm Invision is targeting €400m for the sixth generation of its buyout fund, and there are at least six other firms in this bracket that are expected to launch by the end of the year, according to Unquote Data.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds