DACH activity skyrockets in Q3 despite looming recession

Despite gloomy economic data in Germany, the DACH region has seen high levels of private equity and venture capital activity in Q3 2019. Katharine Hidalgo reports

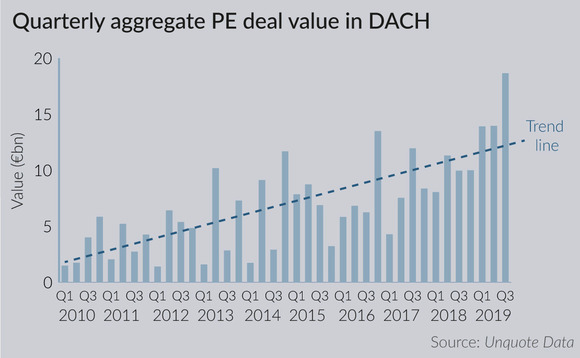

At 159 transactions, the region saw its highest volume of deals ever recorded by Unquote in a single quarter. Aggregate value for the quarter also reached its second highest level at €18.7bn.

Geopolitical turmoil such as the US-China trade war, the ongoing Brexit saga and oil price volatility, following growing tensions in the Middle East, has led to economic contraction of 0.1% for the second quarter of 2019 in Germany, with many fearing a technical recession for Europe's largest economy.

Yet with more dry powder in the market than ever before, GPs continue to deploy capital at a high rate on increasingly large deals in the region. Sascha Pfeiffer, managing director at GCA Altium, says: "In a world of uncertainty, Germany still remains an attractive region. If you look at Europe from a macroeconomic perspective, no one is going to invest in the UK, so where else are you deploying? Italy is notoriously volatile."

Large-cap deals were largely responsible for the high aggregate value, with a total of €12.5bn over seven deals in the quarter. The volume of large-caps (deals valued at more than €500m) per quarter has reached eight transactions, the highest level in Unquote Data history. The largest deal of the quarter was KKR's take-private of Axel Springer, which valued the company at €6.8bn, 9.2x the company's EBITDA.

The aggregate value of expansion deals (in this context meaning funding rounds for companies that are generating revenues) also skyrocketed to its highest value, with almost €3bn across a record 73 deals. The second highest quarterly value was in Q2 2008, with €2.7bn in aggregate value. Project A partner Anton Waitz says: "We had a record year in 2018 in terms of capital invested and we will have a record year in 2019. However, deal count is declining, which ramps up deal sizes as the market becomes more mature."

Even the industrial sector appears resilient, despite spades of negative economic data. IHS Markit's Germany Manufacturing Purchasing Managers Index (PMI) dropped to its lowest level since June 2009. Employment in the sector has fallen for seven months consecutively, with business outlook among manufacturers strongly pessimistic, according to the PMI. Trade tensions have particularly affected the automotive industry, a sector vital to the German economy. Many industrial companies in the region are suppliers to major car manufacturers.

Despite this data, however, Q3 saw a record high volume of 23 buyouts in the industrial sectors. In fact, the sector has reached this volume only twice before: in the second and fourth quarters of 2007.

Standing strong

The Q3 data across both venture capital and private equity seems to mirror pre-crisis volume and value, something that market participants are conscious of. Pfeiffer says: "We are at the end of a very long economic cycle. The economy has been booming for a decade, but the world has become significantly more volatile."

However, Waitz is positive about the venture industry, even following a recession. "I do not think a recession will have a lot of short-term effects on dealflow and on investing, because a lot of funds have raised money and we want to invest this," he says. "Things might slow down but I cannot see us holding money back."

While Pfeiffer expects to see a decline in deal volume and exit activity should a market correction occur, he expects the environment of high-multiple valuations to persist. "There will continue to be a scarcity of resilient companies, so those high multiples will not change," he says. "You will not see valuations drop, there will just be less activity as sellers remain very disciplined."

Healthcare and technology companies, which are generally considered as counter-cyclical, are already trading at a premium to other sectors. In Q3, the average value per buyout in healthcare was €241m, in technology it was €199.5m and in industrials it was €184m.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds