DACH venture and growth deals reach volume high in H1 2020

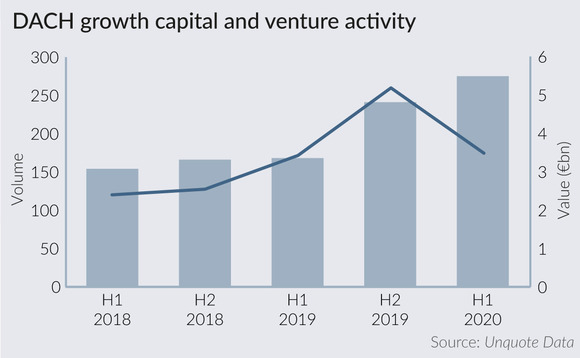

Growth and venture capital deal volume exceeded that of all previous half-yearly figures in the DACH region in H1 2020, making for a busy first half of the year that saw 275 such deals, according to Unquote Data. Harriet Matthews reports

In H1 2020, 275 venture and growth capital deals were completed with an aggregate value of almost €3.5bn, compared with H1 2019's 168 deals totalling €3.4bn. In H2 2019, 241 deals were done with an aggregate value of almost €5.2bn, the previous record for both volume and value in the DACH region.

Furthermore, the onset of the coronavirus pandemic in March did little to curb venture and growth dealdoing in Q2. In fact, activity increased slightly, with 140 deals recorded between April and June versus 135 in Q1.

H2 2019's figures were boosted significantly by mega-rounds of more than €100m, which were effectively considered to be pre-IPO capital; however, the first half of 2020 saw few of such rounds. During H1 2020, the largest rounds were seen when Atomico invested more than $240m in electric aircraft manufacturer Lillium in June 2020, and in the $100m series-D extension for banking startup N26 in May, backed by investors including Battery Ventures, Earlybird and Insight Venture Partners.

The average size of a venture or growth capital round in H1 2020 was €12.7m, compared with €20.4m in H1 2019 and €21.5m in H2 2019. This lower average value is also reflected in the comparison between Q1 and Q2 2020. There were 135 such deals totalling almost €2bn in Q1, compared with 140 deals with an aggregate value of €1.5bn in Q2. This meant an average value of €14.7m in Q1, compared with €10.7m in the following quarter.

Funding the future

Although the venture scene has been active when it comes to deals, a fundraising lull indicates that the region has still suffered from the coronavirus lockdowns first introduced in March 2020. From January to July 2020, DACH venture capital firms held first closes for five funds and final closes for eight funds, raising €1.5bn in total. The same period in 2019 saw almost €2.6bn raised across three first closes and 11 final closes.

Nevertheless, the crisis has piqued the interest of VCs and their LPs alike in digital health. Funds currently on the road in the area include DVH Ventures' Digital Health Fund, Heal Capital's debut fund and Apex Ventures' second fund.

Sascha Alilovic, managing partner at growth investor SHS, told Unquote in April 2020 that LPs are likely to be waiting to see how the healthcare and healthtech markets develop in the wake of the pandemic. He said that while there will be pressure on healthcare systems to prepare for potential future pandemics, healthcare investors will also need to look at the societal impact of their investments and how they can play a role in this transformation.

Shoring up liquidity

The governments in Germany, Austria and Switzerland introduced state-backed programmes to help startups access liquidity as the pandemic developed, with the German Startups Association lobbying to extend the KfW programme to earlier-stage companies, as reported by Unquote in March 2020.

The programme that was eventually introduced in Germany was regarded by many as a welcome recognition of the importance of startups, in spite of its complex structure: Pillar 1 of the programme, known as the Corona Matching Fund, required VC funds to apply to this on behalf of startups valued at more than €50m that had already received VC backing. The KfW would then match money injected by previous VC backers at a 50:50 ratio, although it would contribute a maximum of 70% in some cases. Pillar 2 was aimed at smaller startups that had not had access to private funding and was distributed through the federal states as part of regional support packages.

Many venture capital firms have embraced remote working and investing during lockdown, market players told Unquote in June 2020. However, VCs anticipate potential problems for startups once they reach the end of their runways, which were initially extended either via their government support or recently raised rounds. Travel-focused startups such as GetYourGuide and Flixbus have suffered due to the drop in demand for both local and foreign travel during and beyond the coronavirus lockdowns in Europe.

In spite of the uncertainty, market players are still anticipating that new trends in remote learning and working, security software, robotics and telemedicine are likely to lead to a vibrant startup scene. DACH venture capital and growth deals have held up well under difficult circumstances and the drop in aggregate volume and average volume in H1 2020 indicates that VC players in the region are still managing to deploy their dry powder, albeit in smaller increments, and to support their existing portfolio companies with follow-on rounds.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds