DACH buyout deal value sees sharp summer decline

Following a quiet period for upper-mid-cap dealflow in the DACH region, Harriet Matthews gauges market sentiment as to whether activity could pick up before year-end

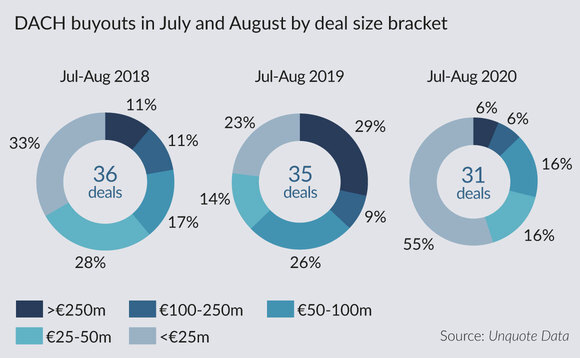

At first glance, activity figures from July and August would suggest that DACH buyout dealflow remained resilient in the face of the ongoing Covid-19 pandemic – much as it did over the second quarter.

But aggregate deal value for buyouts in the region saw a sharp decline over the summer months. The region saw 31 buyouts totalling €2.8bn during the period, versus 35 deals totalling almost €12.7bn in July and August 2019, and 36 buyouts totalling €8.24bn in the same period in 2018. The absence of upper-mid-market deals during this period largely accounts for the fall in aggregate value: just two deals valued at more than €250m were announced in July and August 2020, whereas there were 10 such deals in the same period in 2019, according to Unquote Data.

"The majority of reasons for the drop in aggregate value are related to Covid-19 to some extent," says Christoph Ulrich, a managing director at Duff & Phelps. "But we should be careful to not conclude from these figures that the same type of acquisitions took place as in previous years, but simply at lower valuations."

Indeed, many upper-mid-market processes were put on hold as lockdowns hit across Europe, with the DACH region being no exception. Opportunities at the smaller end of the market were more prominent than in recent years, with deals valued at less than €25m excelling in the DACH region in July and August 2020 in comparison with the previous summer. During this period, buyout deals that took place included HQ Equita's acquisition of microwave components producer Muegge, as well as Bid Equity's acquisitions of Pisa Sales and Infopark. There was one notable exception to the absence of large-cap deals, further highlighting the low average value of buyouts inked over the period: Permira acquired Switzerland-headquartered EF Kids and Teens in a deal valued at $1.5bn in July.

We should be careful to not conclude that the same type of acquisitions took place as in previous years, but simply at lower valuations" – Christoph Ulrich, Duff & Phelps

Reluctant sellers

The consensus among the market sources with whim Unquote spoke is that sponsors and corporates alike have been reluctant to bring businesses to market unless they need to for strategic reasons, or unless they operate in relatively unaffected sectors, in particular software. Says Ulrich: "Anyone who today owns a quality asset will likely be reluctant to put it on the market, unless they can be sure that they can achieve pre-Covid-19 valuation levels in a sale process. It is more a question of the supply of assets than the demand, since the demand is there. But the vast majority of sellers have postponed their exits to Q4 2020, if not to Q1 2021, in order to be able to demonstrate the recovery of the performance of their businesses and achieve respective purchase prices."

Georg Christoph Schneider, a partner at Noerr, expects that some of the processes that were halted when lockdowns took hold might restart in the coming months. "Many typical buyout deals came to a standstill at the start of lockdown and people are considering restarting these processes perhaps at the end of the year. M&A advisers are testing the market with opportunities in smart sectors such as healthcare or IT/software, seeing if the market has the appetite and confidence, so at the end of Q4 we will see a second wave where typical buyout deals that came to a standstill might restart."

Fellow Noerr partner Holger Ebersberger says uncertainty around company financials is still a key factor in delaying larger deals. "The impact on the numbers from coronavirus has not become clear yet and many PE firms and M&A advisers were reluctant to start processes without having robust numbers. It is a question of the right timing, the right purchase price and multiple. We are not seeing so many billion-euro transactions in the market yet – beyond coronavirus and the compression of the deals landscape in the second quarter of 2020, there could be other reasons [for the fall in aggregate deal value] that are not entirely clear. Economic pressures on companies could encourage strategic reviews and disposals and create further opportunities in the market to do big deals."

Hendrik Hirsch, a partner at CMS, says companies and advisers are looking for ways to mitigate this uncertainty to get larger deals done. "Many sellers decided to provide additional financial data, to show whether the effect of coronavirus was long-term. Some deals could have been much quicker, but they decided it would be helpful to provide more additional intelligence on the Covid-19 impact. For one deal that we did, we were able to update the interested parties on actuals and we came up with a specific report on Covid-19 impact, as an additional fact book, which is very common now."

The DACH region saw its first large-cap deal in two months in September 2020, when Apax sold Neuraxpharm to Permira in a deal valued at more than €1.6bn, following a fast-moving auction process. Market players expect sponsors to be ready with large amounts of dry powder following months when deal-closing was on hold. "Generally, clients of ours with deeper pockets and who are well-funded feel that it is their time to go out into the market," says Hirsch.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds