Appetite for DACH tech deals continues apace in Q1

Technology buyouts in the DACH region have remained consistently popular in Q1 2021, according to Unquote Data, accompanied by high multiples and competitive exit opportunities. Harriet Matthews looks at the factors behind the interest and recent activity in the sector

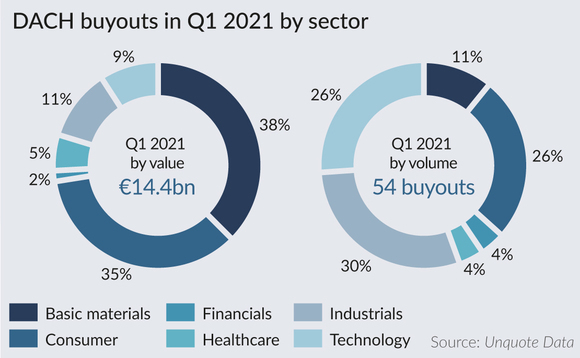

Technology deals (and specifically the sub-sectors of software and computer services) accounted for more than a quarter (26%) of buyout volume recorded in the DACH region in Q1 2021, almost overtaking the region's traditionally strong industrials sector (28%). This follows on from Q4 2020 during which 32% of buyouts were in the industrials sector, while 30% were technology deals.

Marco Krass, a director specialising in technology and services at Baird, notes that the IT services sector in particular has historically been consistent in its popularity among PE players, but this by no means indicates that opportunities in the sector have been exhausted: "Traditionally there has been a good level of interest in differentiated IT services in DACH, since it is a broad, large and fragmented market that has seen a good level of consolidation, but still offers significant opportunities for active buy-and-build, including transformative M&A."

Krass adds that further technology sub-sectors are currently generating even more interest and commanding even higher prices: "Other tech and services sub-sectors have seen an even stronger uplift than IT services, such as software providers and SaaS businesses, for which multiples are frequently in the high teens, or even 20-25x or more in recent transactions – multiples have significantly elevated in this segment."

There is massive interest for these technology companies, they often grow at 25-50-100% per year, so they are quickly in a size range that makes them attractive for PE" – Marco Krass, Baird

Deals that took place in the technology sector in Q1 include HIG Europe's sale of its stake in Swiss IT security business Infinigate to Bridgepoint, as well as Harald Quandt Industriebeteiligungen (HQIB) and Cadence Growth Capital's (CGC) acquisition and merger of Germany-based IT businesses Horn & Cosifan and PK Office.

In addition to HQIB and CGC, sponsors in the sector currently pursuing a buy-and-build strategy include Waterland, via Netgo and Gesellschaft für Organisation und Datenverarbeitung (GOD).

Current processes underway in the technology sector include the sale of Ufenau's buy-and-build IT security service Swiss IT Security, as reported by Unquote sister publication Mergermarket.

Krass confirms that activity in the technology sector is continuing at a strong pace: "A lot of new processes have been and are being launched – the broader tech & services market was clearly not as impacted as more cyclical sectors. In some sectors, exits were moved out, but this was generally not applicable for tech and services.

"There is massive interest for these technology companies, they often grow at 25-50-100% per year, so they are quickly in a size range that makes them attractive for PE, even if they currently are still of smaller scale and have venture backing," says Krass, noting that VC portfolios are good sources of potential deals.

Where's the exit?

Technology businesses can generate strong valuations, particularly when they develop in size and the complexity of services that they offer. "Multiples for companies with a strong position in digital transformation, digitalisation of processes and workflows, cybersecurity or AI have evolved as the growth profile of these companies has evolved," says Krass. "There is a strong need for digital transformation in both the enterprise space and in the public sector. The current environment has clearly had an impact on those multiples. IT services were previously in the 8-12x range, they are now elevated to 12-14x or above."

Exit prospects for sponsors investing in the sector also make these deals appealing. Exits from technology businesses made up one third of the exits recorded in Q1 2021 by volume, with consumer and goods taking second place with 26%, showing that GPs have not had issues in selling these assets.

While economic crises often result in longer holding periods while sellers look for market stability, this is not a trend observed in the IT sector. Says Krass: "We are seeing that holding periods for companies that play in an attractive market, that show a sustainably attractive growth profile, with high revenue visibility and strong resilience, have actually come down – investors are taking advantage of the M&A market conditions and strong demand for assets with these healthy characteristics. Buyers are willing to pay attractive multiples for these businesses."

One deal from 2020 that exemplifies this is Investcorp's investment in cybersecurity company Avira. The GP sold the company to industry giant NortonLifeLock in December 2020 for $360m after eight months of ownership, netting more than 2x money and 200% IRR, as reported by Unquote. At the time, Gilbert Kamieniecky, managing director and head of technology-focused private equity at Investcorp, told Unquote that the company outperformed the GP's expectations and that an inbound approach came from Norton.

Stiff competition

As a sub-sector, IT services has not typically generated multi-billion-euro deals, or even deals valued in the hundreds of millions, at the primary buyout level. The sector is generally made up of small businesses, meaning that small-cap or mid-market GPs can make headway in the sector, unlike in many other technology sub-sectors, allowing them to benefit from overall trends towards digitalisation. This is reflected in the fact that Q1 2021's technology buyouts made up just 9% of deals by value.

However, there is room for growth and for larger deals, Krass says: "Secondary and tertiary buyouts, or even buyouts beyond this, are possible for these businesses – if a company can really evolve and continue to show a good growth story in the years ahead, bigger funds can come in."

Large-cap DACH deals in the sector in recent years have included Insight Partners' $5bn acquisition of Switzerland-based data management software Veeam in early 2020 (the company's headquarters were subsequently moved to the US). In late 2019, Hg acquired Germany-based HR software Personal & Informatik (P&I) from Permira in a €2bn SBO.

"Strategics are also showing interest; it's an attractive market in terms of mega-trends, which makes it a good place to invest," says Krass. "There are large corporate players in the sector, and the continued growth of such assets means that larger sponsors can acquire them in time as well, if they remain in the hands of private equity."

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds