Steadfast sells Stanzwerk Jessen to trade

Steadfast Capital has sold machinery component manufacturer Stanzwerk Jessen to listed trade buyer Feintool.

The sale generated an IRR of 50% over the two-year holding period, Unquote understands.

It is the second exit from Steadfast Capital III, following the sale of road safety service AVS Verkehrssicherung to Triton Partners in November 2017, which resulted in a 10.7x return.

Fund III held a final close on €128m against a €250m target in June 2011 and was generating a 2.1x multiple and 150% DPI after the AVS exit.

Steadfast is currently raising for its fourth fund and held a first close on €220m in June, with a target of €250m and a €300m hard-cap.

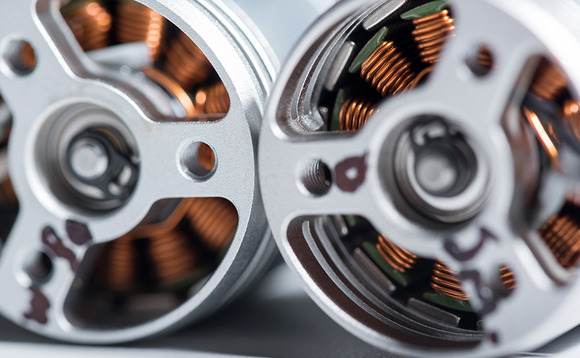

For Feintool, the acquisition represents an expansion into the electrical motor component market. It has mostly focused on components for traditional motors in the past.

When Steadfast acquired Stanzwerk in July 2016, it generated EBITDA of €4.5m from €35m in sales. Approximately 60% of its revenues came from bespoke component manufacturing and 40% from smaller sales of generalist parts.

Under Steadfast's ownership, the portion of sales for bespoke services to industrial clients was increased to 85%, resulting in revenues of €37m and EBITDA of €6.4m for 2017 and projected revenues of €42m and €7.2m EBITDA for 2018.

The sale was conducted without an M&A adviser and received interest exclusively from strategic buyers.

Previous funding

Steadfast bought Stanzwerk from Orlando Management in an auction conducted by Imap in July 2017. Orlando initially bought the profitable business from its insolvent parent company in 2013.

Company

Founded in 1879 as a metal processing company, Stanzwerk Jessen is now a manufacturer of high-precision, tool-based electrical sheet parts for electric motors and transformers. The components are manufactured at two production sites in Jessen and are predominately used by customers in the automation and automotive sectors. The company employs 200 people and projected EBITDA of €7.2m from revenues of €42m for 2018.

People

Steadfast Capital Partners – Marco Bernecker (managing partner).

Feintool – Knut Zimmer (CEO).

Advisers

Vendor – Mayer Brown, Julien Lernor, Birgit Hübscher-Alt (legal); EY, Uwe Bühler (tax); Rödl & Partner, Jochen Reis (financial due diligence).

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds